Happy Friday, friends 👋

Some housekeeping before we get going. We’re delighted to announce that we’re opening up FWDstart to outside contributors! Titles don’t matter – journalist, founder, investor, operator, or something in between. What matters is that you’re research-driven, opinionated in the right ways, and have something original to add to the conversation.

If that sounds like you, or someone you know – pitches are open here.

We kick off this week’s edition with Gathern’s $72M Series B, led by Sanabil Investments. Often described as Saudi’s answer to Airbnb, Gathern has broken from regional norms by disclosing its valuation, over $266M, and by signalling its ambition to list on Tadawul, though without committing to a specific year. We jest, but the latter is highly unusual for a Series B company these days. Founded in 2017 by Latifah Altamimi, Gathern’s raise also stands out as, to the best of our knowledge, the largest round ever closed by a woman-led startup in MENA.

Next up: Robinhood is making a push into Dubai. The US trading giant has applied for a DFSA license and tapped Mario Camara, formerly of Equiti and Saxo Bank, to lead its regional expansion. Robinhood has been one of the defining stories of the US stock market over the past year, with its share price up more than 400% and its market cap now approaching $100B. But in the UAE, it won’t be the Sheriff of Nottingham standing in its way, rather it will find adversaries in the guise of local incumbents like Sarwa, Baraka, and Thnder.

Elsewhere, Keeta continues its march across the GCC, launching in Qatar after earlier expansions in Saudi Arabia and the UAE. Fuze has been fined by Dubai’s Virtual Assets Regulatory Authority for reported weak anti-money-laundering controls. And Rebellions, the Wa’ed Ventures and Samsung-backed AI chip startup positioning itself as a rival to NVIDIA, has established a new unit in Riyadh to supply Aramco’s AI data centres.

And finally: if you missed it, check out this week’s deep dive on the battle to own Arabic AI voice. It’s a comprehensive primer on the regional landscape and where the next breakthroughs might come from.

Now, let’s get into this week’s edition 👇

This week’s round-up is a 5 min read:

Swap, Bridge, and Track Tokens Across 14+ Chains

Meet the Uniswap web app — your hub for swapping, bridging, and buying crypto across Ethereum and 14 additional networks.

Access thousands of tokens and move assets between chains, all from a single, easy-to-use interface.

Trusted by millions, Uniswap includes real-time token warnings to help you avoid risky tokens, along with transparent pricing and open-source, audited contracts.

Whether you're exploring new tokens, bridging across networks, or making your first swap, Uniswap keeps onchain trading simple and secure.

Just connect your wallet to get started.

🚀 Startup funding round-up

Gathern (🇸🇦 KSA), the Kingdom’s largest P2P rental marketplace offering 35,000+ accommodations across 280 cities, has closed a $72M Series B led by Sanabil Investments, with participation from STV, Nuwa Capital, Endeavor Catalyst, Pinnacle Capital, and other strategic investors. The raise values the company at over SAR 1B ($266M) and paves the way for a potential IPO on the Saudi stock exchange.

Fahy Studios (🇸🇦 KSA), a hybrid-casual mobile games studio, has raised $1.75M from Impact46 and Merak Capital to expand production and accelerate its global pipeline. Founded in 2023, the studio emerged from NEOM’s LevelUp accelerator and has signed a publishing partnership with UK-based Kwalee. Fahy is currently developing RAWR, Footy Traps, and Heist Party.

Starvania Studio (🇸🇦 KSA), an indie studio creating fantasy-rich console and PC games, has secured $1.1M from Merak Capital and Impact46. Founded in 2022, Starvania gained recognition with Bahamut and the Waqwaq Tree on Steam, and the funding will scale production capabilities, expand its team, and support the development of original IPs with cross-media potential.

Zaher AI (🇪🇬 Egypt), founded in 2025, has raised $150K from Miska Venture Studio and angel investors to launch its Generative Engine Optimisation (GEO) platform in Arabic, helping enterprises improve visibility across AI channels.

Catch up on recent deep-dives

💰 Fintech

🇺🇸 Robinhood is preparing to launch in Dubai, applying for a Category 4 DFSA license to onboard clients across the UAE and wider MENA from its new DIFC base. The U.S. neobroker has begun hiring locally, naming ex-Equiti and Saxo Bank exec Mario Camara as Senior Executive Officer, with a formal launch expected in the coming weeks. The move puts Robinhood head-to-head with regional wealth-tech players including Sarwa, Baraka, and Thndr. Robinhood’s Dubai entry follows expansions into the UK and EU, with Singapore lined up as its Asia hub.

🚨 Dubai’s Virtual Assets Regulatory Authority (VARA) has fined Fuze (Morpheus Software Technology FZE) for weak anti-money laundering controls and unlicensed virtual asset activity, placing the ADQ-backed startup under ongoing supervision with remedial actions led by an independent expert; Fuze said the matter related to a limited set of historical transactions, halted the activities once flagged, and has since bolstered compliance with new leadership hires and external advisors, while stressing its core digital-asset-as-a-service platform, which powers banks and fintechs and recently raised $12.2M in a Galaxy-led Series A, remains unaffected.

🍔 Delivery & Q-Commerce

🛵 Jahez has secured a $40M Shariah-compliant facility from the National Bank of Bahrain to fund its new headquarters, with an eight-year duration. The financing comes as the Saudi-listed delivery platform reported a 22% YoY drop in Q2 2025 net profit to $6.29M, citing weaker adjusted EBITDA and higher depreciation. The company, which operates across Saudi, Bahrain, and Kuwait, recently acquired a 76.56% stake in Qatar’s Snoonu for $245M, expanding its regional on-demand delivery footprint.

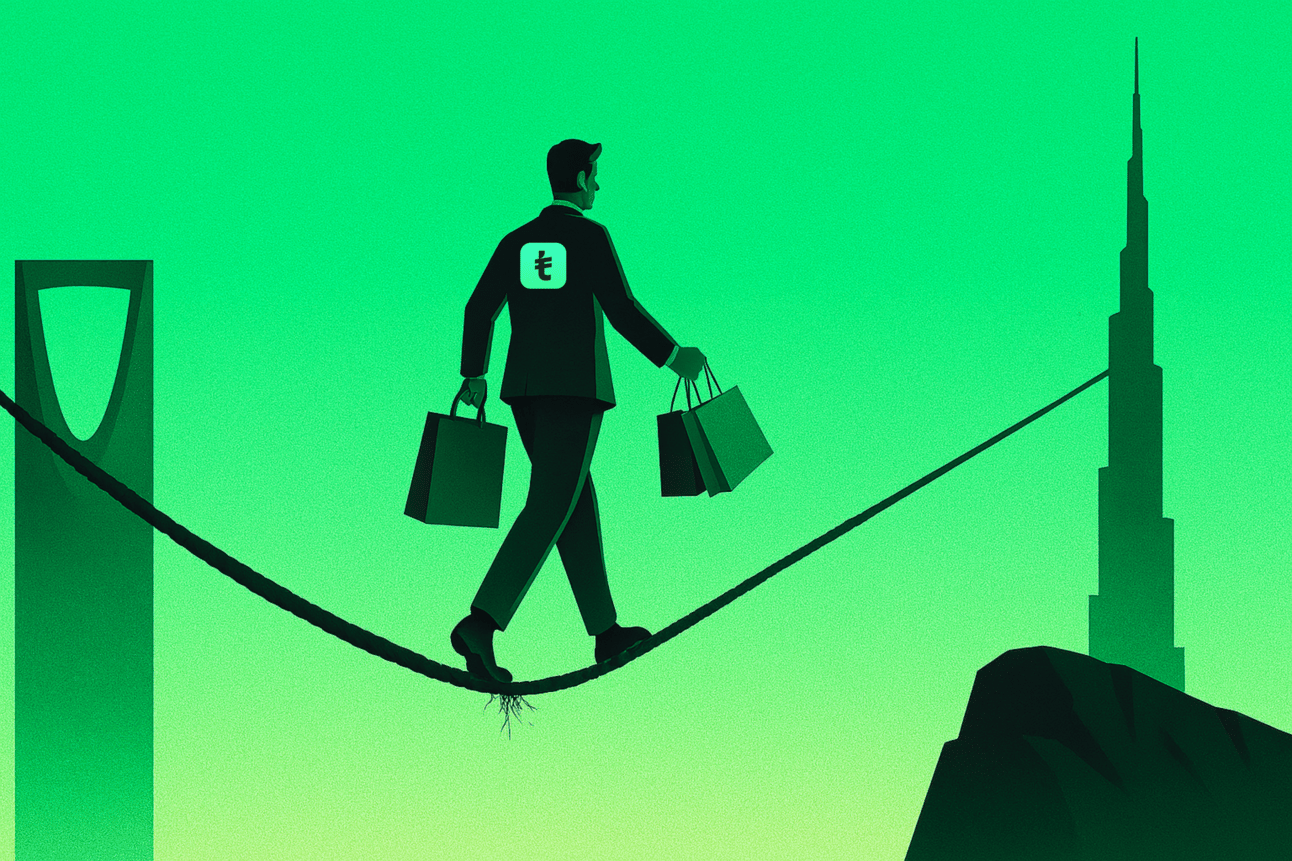

🇶🇦 Keeta, the international arm of China’s Meituan, has officially launched in Qatar, offering unlimited free delivery, on-time guarantees, and QR200 in vouchers for new users. The launch follows earlier rollouts in Dubai and Saudi Arabia, extending Meituan’s scale, over 150M peak daily orders and 770M users, to the Gulf

🤖 AI

🇰🇷 Rebellions, a South Korean AI chip startup, has set up a Saudi unit in Riyadh to supply Aramco’s AI data centres, following a $14.4M Wa’ed Ventures investment and ongoing collaborations on customised semiconductor solutions. The new hub will accelerate delivery of its 5nm NPU products while exploring partnerships with Saudi telecom and IT firms as the Kingdom builds out sovereign AI infrastructure. Rebellions also raised funding from Samsung in July and is targeting a $150M–$200M round ahead of an IPO, after its 2023 merger with Sapeon positioned it as a homegrown rival to NVIDIA and AMD.

🇺🇸 Databricks is raising a Series K at a $100B+ valuation, with funding from existing backers to accelerate its AI strategy, including Agent Bricks and its new Lakebase database. The San Francisco-based firm, backed by Saudi’s Sanabil Investments, has also committed $300M over five years in Saudi Arabia to support AI adoption, workforce upskilling, and local partnerships. Databricks opened its Riyadh office in Dec 2024

💸 VC

🇸🇦 Exel by Merak has invested $5.1M across 17 gaming startups, each receiving $300K plus mentorship, as part of its first cohort selected from 300+ global applications. The accelerator, powered by Merak Capital’s $80M gaming fund and backed by the NDF and SDB, aims to build a long-term pipeline for Saudi gaming. Full cohort here.

🇸🇦 Standard Chartered, in partnership with Falak Investment Hub, has selected 10 women-led Saudi startups for the third cohort of its Futuremakers Women in Tech programme. Selected startups include Makan Design, Pixconvey, Wittify, Talents Arena, Decorist.ai, SDM, Taawoni, Aya, Hakiem, and Adel, spanning AI, SaaS, healthtech, HR, e-commerce, and legaltech.

🌍 International Investments

🇦🇪 CE-Ventures, the corporate VC arm of Crescent Enterprises, has joined the $100M Series B of US-based Aalo Atomics, a next-gen nuclear startup backed by Valor Equity, Hitachi Ventures, and others. The funding will support Aalo’s first modular nuclear plant, targeting zero-power criticality by July 2026 to demonstrate how its reactors can power AI-optimized data centres. Aalo, incorporated in 2022, was recently selected by the US DOE for fast-tracked testing of its advanced nuclear tech.