Happy Friday, friends 👋

A very quick ask before we get into this week’s edition – if you enjoy FWDstart:

Consider becoming a paid subscriber – it works out at about $0.27 per day and helps us keep producing long-form reporting and analysis.

Please share the newsletter with your friends, colleagues, employees, family, acquaintances, even pets – it really helps!

Now, where were we – ah, yes. It’s fair to say it’s been a busy week for the region’s sovereigns. PIF is behind the largest-ever leveraged buyout of a gaming company, taking Electronic Arts private in a $55 billion deal brokered by Jared Kushner’s Affinity Partners. The fund is Affinity’s largest backer, having committed $2 billion to the firm.

The deal values EA at roughly 29 times EBITDA, far higher than the multiples you’d usually expect for pure gaming and esports companies. How paying such a premium plays out over the long term will be interesting to keep an eye on. It also begs the question: after Niantic, Nintendo, and now EA, who could be next on the shopping list?

Meanwhile, the UAE’s MGX is reportedly preparing to take a 15% stake in the newly carved-out U.S. TikTok entity. The AI investment vehicle chaired by Sheikh Tahnoon bin Zayed Al Nahyan also joined a $6.6 billion secondary share sale in OpenAI, which set the company’s valuation at $500 billion.

Closer to home, BECO Capital announced the close of two new funds this week: the $120 million Fund IV, its fourth early-stage vehicle, and a $250 million growth fund targeting companies from Series B to pre-IPO. In doing so, BECO is following the precedent of 500 Global, positioning itself as a full-stack platform for founders, with complementary funds designed to back startups from their earliest stages all the way through to exit.

Enjoy this week’s edition 👇

This week’s round-up is an 7 min read:

🚀 Startup funding round-up

Upfront (🇦🇪 UAE), a fintech building a financial operating system for SMBs, has secured $10M in pre-seed funding (debt + equity mix) co-led by Palm Ventures and SABAH.fund.

Aydi (🇪🇬 Egypt), an agritech startup, has raised $7.5M in seed funding led by COTU Ventures, Daltex, and Nuwa Capital, with participation from Magrabi Agriculture and Foundation Ventures, to launch and scale Orth, its AI-powered agronomy assistant that combines satellite monitoring, predictive analytics, and conversational AI to deliver plot-level precision and boost yields by 20%+.

Tokinvest (🇦🇪 UAE), a marketplace for tokenised real-world assets, has raised $3.2M in pre-seed funding and secured a multi-asset licence from VARA.

Climaty AI (🇦🇪 UAE), a platform using agentic AI to cut and offset carbon emissions from media campaigns, has raised $2M in seed funding led by Turbostart.

Sadq (🇸🇦 KSA), a digital trust solutions platform providing e-signature and identity verification services, has raised $1M in pre-Series A extension funding from Impact46.

Tadawulcom (🇸🇦 KSA), a proptech startup digitising real estate brokerage services including listings, contracts, and storefronts, has closed a $400K seed round led by an angel investor.

Sabika (🇪🇬 Egypt), a Sharia-compliant gold and silver investment platform, has raised a strategic six-figure USD investment led by M-Empire Angels to expand in Egypt and the Gulf.

Plstka (🇪🇬 Egypt), a climate tech startup using an incentive-based recycling app and AI-powered ERP system to optimise the waste supply chain, has secured a new six-figure investment from Empire Angels Bridge.

Recent deep-dives

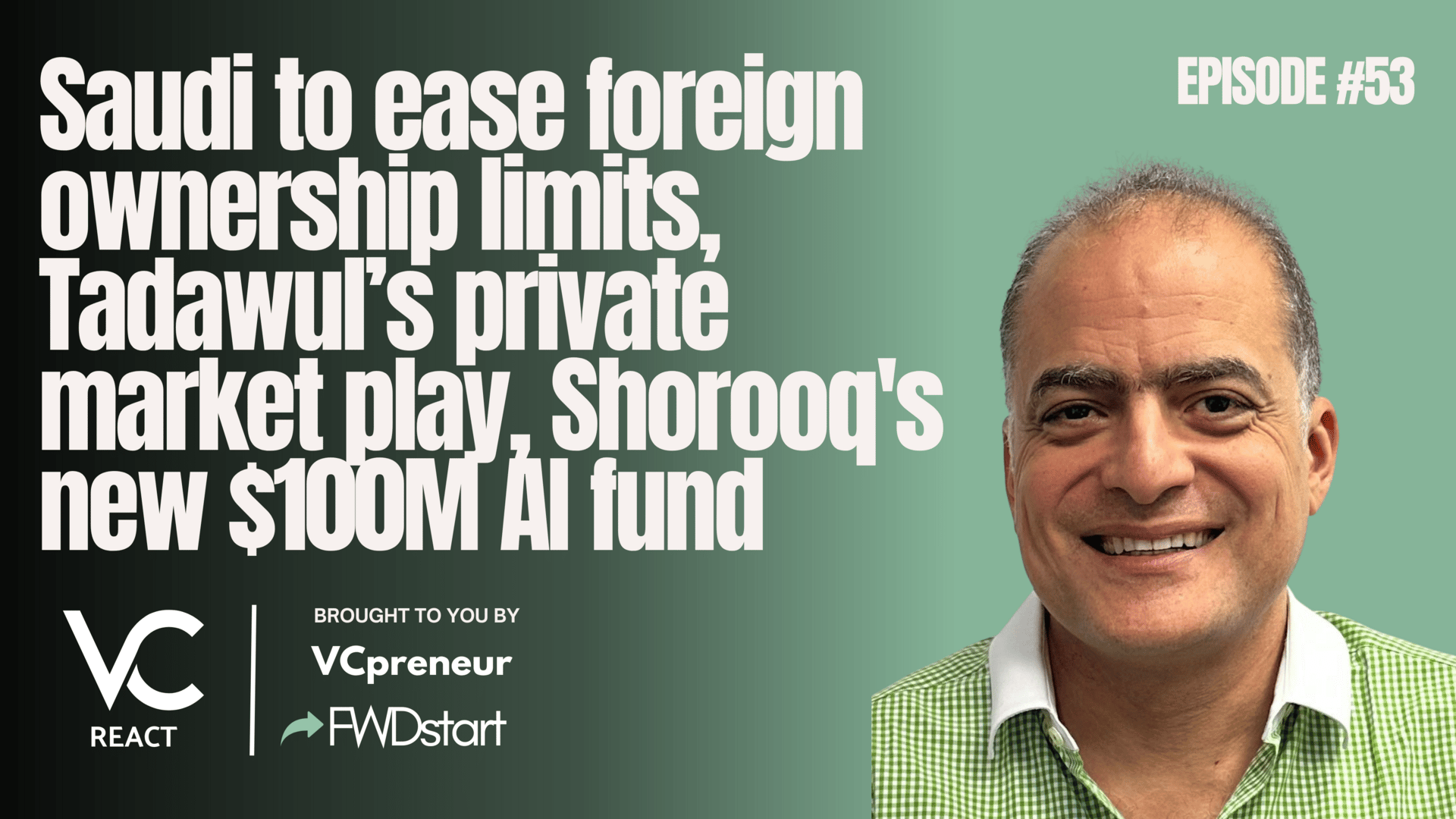

💸 VC

🇦🇪 BECO Capital has closed $370M across two new funds, boosting its firepower from pre-seed through IPO. The raise includes $120M for BECO Fund IV, its fourth early-stage vehicle, and a $250M Growth Fund targeting Series B to pre-IPO scale-ups. With the fresh capital, BECO now manages $820M+ AUM. Fund IV will continue backing early-stage bets across construction tech, fintech, proptech, consumer tech and AI. The Growth Fund, led by GP Amer Alaily, will deploy ~$20M checks into late-stage Gulf startups to fill the region’s growth capital gap. Founded in 2012, BECO was one of the Gulf’s first VCs and has backed Careem, Property Finder and Kitopi.

🇸🇦🇺🇸 Riyadh-based Sukna Capital has teamed up with US growth lender Partners for Growth (PFG) to roll out a $50 million specialty lending initiative for tech firms and SMEs across Saudi Arabia and MENA. The vehicle, managed through Sukna’s Sukna Fund for Direct Financing (SFDF), is the Kingdom’s first open-ended Sharia-compliant direct lending fund, offering non-dilutive facilities such as term loans, working-capital lines, and contract financing.

🇦🇪🇬🇷 Iliad Partners closed the second round of its $50M Tech Ventures Fund I, adding Eurobank, National Bank of Greece, and Piraeus Bank as LPs. It’s the first time the three Greek banks have invested in MENA VC. The fund, now close to doubling its AUM, will back early-stage B2B software startups in fintech, logistics, and proptech, with a focus on Saudi Arabia, the UAE, and Greece. To date, Iliad has invested in startups including Tadamon, Cypherleak, and SpiderSilk.

🇸🇦👗 Saudi Arabia’s Cultural Development Fund has partnered with Merak Capital to launch an $80 million private equity fashion fund targeting growth-stage companies across apparel, accessories, e-commerce, beauty, and supply chain enablers. The Fashion Fund, announced during the Cultural Investment Conference, will prioritise Saudi brands and innovative businesses that harness technology and new models to scale globally.

🤝 M&A

🕹️ Electronic Arts will be taken private in a record $55 billion leveraged buyout, with Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Kushner’s Affinity Partners paying $210 per share in cash. JPMorgan is providing a $20B loan to support the deal. Saudi’s PIF will hold a controlling stake, while Affinity takes the smallest share. Kushner, who has deep financial ties to PIF (including a $2B commitment to Affinity in 2021), played a central role in initiating and sustaining talks. The deal still requires CFIUS approval, where scrutiny may hinge on Trump’s fast-track approach to Mideast wealth funds versus past administrations’ tougher stance. For PIF, the buyout is a milestone in its bid to make Saudi Arabia a global hub for gaming and esports, building on earlier stakes in Activision Blizzard, Nintendo, and Capcom.

🚗 Careem has acquired a minority stake in Swapp, the UAE-based digital car rental and subscription platform already integrated into the Careem Everything App since 2022. Swapp’s marketplace sources vehicles from leasing companies, OEMs, and its own EV fleet, offering delivery in 24 hours with no paperwork. The investment will deepen integration with new features like instant KYC, one-hour car delivery, real-time tracking, on-demand swaps, and lease-to-own options. Swapp plans regional expansion and multi-month rentals as it enters its next growth stage.

📱State-backed Emirati investor MGX, chaired by Sheikh Tahnoon bin Zayed Al Nahyan, is preparing to take a 15% stake in TikTok’s US operations, alongside Oracle and Silver Lake, in a White House-brokered agreement that values the unit at $14B, Bloomberg reports. Under the proposed structure, ByteDance will retain a 19.9% stake, while US firms and MGX would control the remainder. The deal follows an executive order signed by President Trump giving 120 days to finalise terms. TikTok, with 170M US users out of a global 1.6B base, faces ongoing national security scrutiny over data access. The move deepens MGX’s US tech footprint after recently co-investing in chipmaker Altera with Silver Lake.

🤖 AI

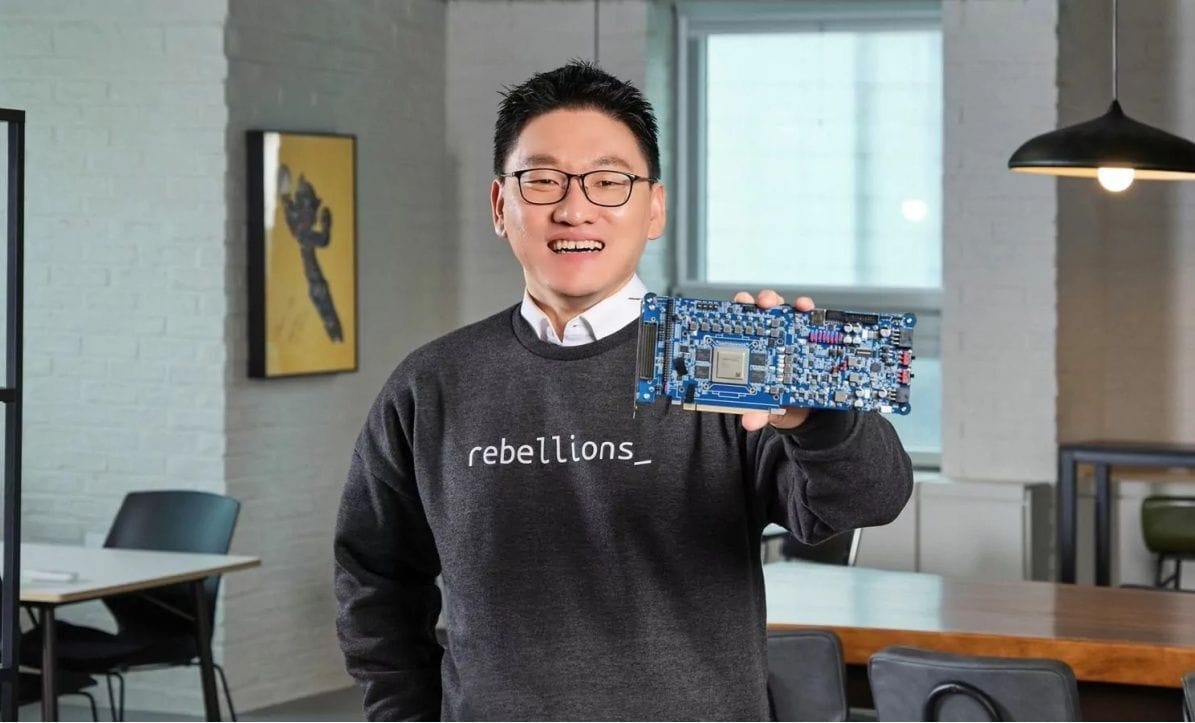

💾 South Korea’s Rebellions, one of Asia’s fastest-growing AI chip startups, has raised $250M in Series C funding at a $1.4B valuation, backed by Arm, Samsung Ventures, Pegatron VC, Korea Development Bank, Korelya Capital, and Lion X Ventures. Arm also joined as a strategic partner to advance next-gen AI data center infrastructure. The raise comes just over a year after Saudi Aramco’s Wa’ed Ventures led a $15M Series B extension, marking Rebellions’ entry into the Kingdom, where it has since set up a Riyadh subsidiary and deployed its ATOM™ inference chips.

🇦🇪 Abu Dhabi’s MGX has joined SoftBank, Thrive Capital, Dragoneer, and T. Rowe Price in a $6.6B secondary share sale that values OpenAI at $500B, up from $300B previously, Reuters reported. The stakes were sold by current and former employees as part of a broader $10B+ authorized share sale program. OpenAI generated about $4.3B in revenue in the first half of 2025, already surpassing full-year 2024.

🇨🇳 Alibaba announced plans to build a data centre in Dubai by 2026, part of a wider international rollout that includes Mexico, Japan, South Korea, and Malaysia. The move comes as the company reported a 26% YoY jump in cloud revenue in Q1 2025, driven by AI demand. At its Apsara Conference, CEO Eddie Wu said AI development is outpacing expectations, with Alibaba also partnering with Nvidia on AI infrastructure capabilities spanning data synthesis, model training, and simulation. It did not confirm whether Nvidia chips would power the new sites.

🌍 International Investments

🇸🇦🇬🇧 Aramco Ventures has invested in UK-based OXCCU’s $28M Series B to scale its one-step process for converting waste carbon into sustainable aviation fuel (SAF). Other investors include Orlen VC, Safran Corporate Ventures, IAG, Hostplus, TCVC, Clean Energy Ventures, IP Group/Kiko Ventures, Eni Next, Braavos Capital, and the University of Oxford. Founded in 2021 as an Oxford University spin-out, OXCCU is developing catalysts and reactors to make SAF production cheaper and more scalable.

🇧🇭🇺🇸 Bahrain’s Arcapita Group has emerged as a lead investor in Figure AI’s $1B Series C round, which values the California-based humanoid robotics startup at $39B. The round was co-led with Parkway Venture Capital, and joined by Brookfield, Nvidia, Salesforce, Intel Capital, and Macquarie Capital. Figure AI is developing autonomous humanoid robots for commercial and industrial applications, with Brookfield planning pilot deployments across its global real estate portfolio of 100,000+ residential units.

🇴🇲🇬🇧 Oman’s OIA has invested in UK-based Salience Labs through its Future Generations Fund, backing its development of optical chips that accelerate data transfer and AI training. The deal, supported by OIA’s partnerships with Oxford Science Enterprises and Cambridge Innovation Capital, expands its AI portfolio – which also includes xAI, Sense, Gradiant/Turing, and Crusoe Energy – as Oman pushes to build a regional hub for AI and digital infrastructure.

💳 Fintech

🇸🇦 Saudi Arabia’s central bank (SAMA) has introduced two major updates: visitors will now be able to open bank accounts using a new “Visitor ID” issued by the Ministry of Interior, streamlining access to financial services during their stay, and SAMA has also licensed EZ Bank, a digital lender backed by Ajlan & Bros Holding Group and Qatar National Bank (QNB) with SAR 2.5 billion in capital. The new license raises the number of digital banks in the Kingdom to four and brings the total number of licensed banks to 39, including 15 local lenders and 24 foreign branches.

🛵 Food delivery

🇨🇳🇦🇪 China’s Meituan has launched its Keeta delivery brand in Dubai, its third new Middle Eastern market in 40 days after Qatar and Kuwait, and fourth Gulf foothold after Saudi Arabia. Dubai will also serve as the first overseas hub for Keeta Drone, integrating ground and low-altitude delivery to scale on-demand retail. Meituan first rolled out Keeta in Hong Kong in May 2023 and expanded to Saudi Arabia last year, where it now covers 20 cities.