Happy Friday, friends 👋

If your LinkedIn feed looks anything like ours, it’s probably been a merry-go-round of regional tech CFOs making the media rounds to talk up their H1 results. If you’ve struggled to keep up, worry not – we’ve done the heavy lifting with a skimmable drill-down on Talabat, Valu, Jahez, and Presight.

Elsewhere, HUMAIN CEO Tareq Amin revealed that Saudi’s state-backed AI vehicle will launch a bigger and better Arabic-centric general-purpose foundation model by the end of August, aimed at sovereign, enterprise, and research use. We’ll be watching closely to see how it compares to UAE-based Inception’s Jais Arabic LLM.

Impact46 has been putting its $40M gaming fund to work, this week announcing $6.6M+ in collective investments across five studios.

We’re also keeping an eye on the earned wage access space in Saudi Arabia, with Pakistan’s Abhi entering the market on the back of a $200M partnership with Alraedah. The rollout puts them up against FlexxPay, Mudad + Khazna, and Cairo-based NowPay, which partnered with United International Holding earlier this year.

Now, let’s get into this week’s edition 👇

This week’s round-up is a 5 min read:

20-Minute Masterclass: Never Lose Another Deal in Your Pipeline Again!

Live 20-min workshop • Wed 20th Aug (1pm GMT+4 / 11 am CET)

In just 20 minutes, discover the AI-powered outreach playbooks that took startups from $1M → $5M ARR without extra headcount.

✔️ The hidden revenue in your existing pipeline

✔️ Live build: Building your revenue dashboard

✔️ 3-tier deal scoring and alerts system

✔️ Weekly pipeline review framework

✔️ Learn how to go from reactive to predictive selling

🚀 Startup funding round-up

Professional.me (🇦🇪 UAE), an agentic-AI powered talent management platform designed to help organisations understand, grow, and retain their workforce has closed a $3.1M seed round led by Raha Beach Ventures.

Coraly.ai (🇦🇪 UAE), formerly Coralytics, an AI growth platform for agents and brokerages offering lead enrichment, automated campaigns, and performance insights, has raised $2M in a pre-seed round led by Salica Oryx Fund (managed by Salica Investments) with participation from EQ2 Ventures and strategic angels to accelerate product innovation and expand into key growth markets.

Hypeo Ai (🇲🇦 Morocco), a platform that connects brands with human and virtual creators in minutes, streamlining influencer campaigns with smart matching, pricing insights and real-time tracking, has secured an undisclosed investment from Renew Capital.

Circle (🇦🇪 UAE), a second-hand fashion platform reimagining how MENAP shops pre-owned apparel, has raised a pre-seed round led by Antler to scale across MENAP starting with the GCC.

Fahy Studios founders Fahad Alshibl and Hani Hashem

Fahy Studios (🇸🇦 KSA), a Riyadh-based hybrid-casual mobile game studio backed by NEOM’s Level Up accelerator (and the first Saudi studio to secure a global publishing deal with UK-based Kwalee), has received an undisclosed investment from Impact46 as part of a SAR 25 million+ gaming fund deployment.

NJD (🇸🇦 KSA), another Riyadh-based mobile game studio focused on crafting engaging IP for regional and global audiences, has also secured an undisclosed investment from Impact46 under the same gaming fund.

Game Cooks (🇱🇧 Lebanon), a Beirut- and San Francisco-founded studio that has shipped over 22 VR, mobile, and PC titles and received multiple international awards, is expanding into Saudi Arabia, backed by Impact46’s investment.

Starvania (🇸🇦 KSA),a Saudi indie PC and console fantasy game studio founded by Meaad Aflah and Muslih Alzahrani (notable for winning Best Game Startup at the MENA Games Industry Awards 2024 and supported by NEOM’s Level Up accelerator), has also secured Impact46 funding.

Catch up on recent deep-dives

📈 Results

Jahez (H1 2025): Profit up 38% to $15.7m, revenue growth modest, Q2 earnings dipped on softer margins and promo pressure. More here.

Presight (H1 2025): Revenue $300m, +80% YoY, international mix higher, backlog $1.01bn supports visibility. More here.

Valu (H1 2025): Revenue $53.6m, +94% YoY, net profit $7.0m, +64% YoY, demand broad across product lines. More here.

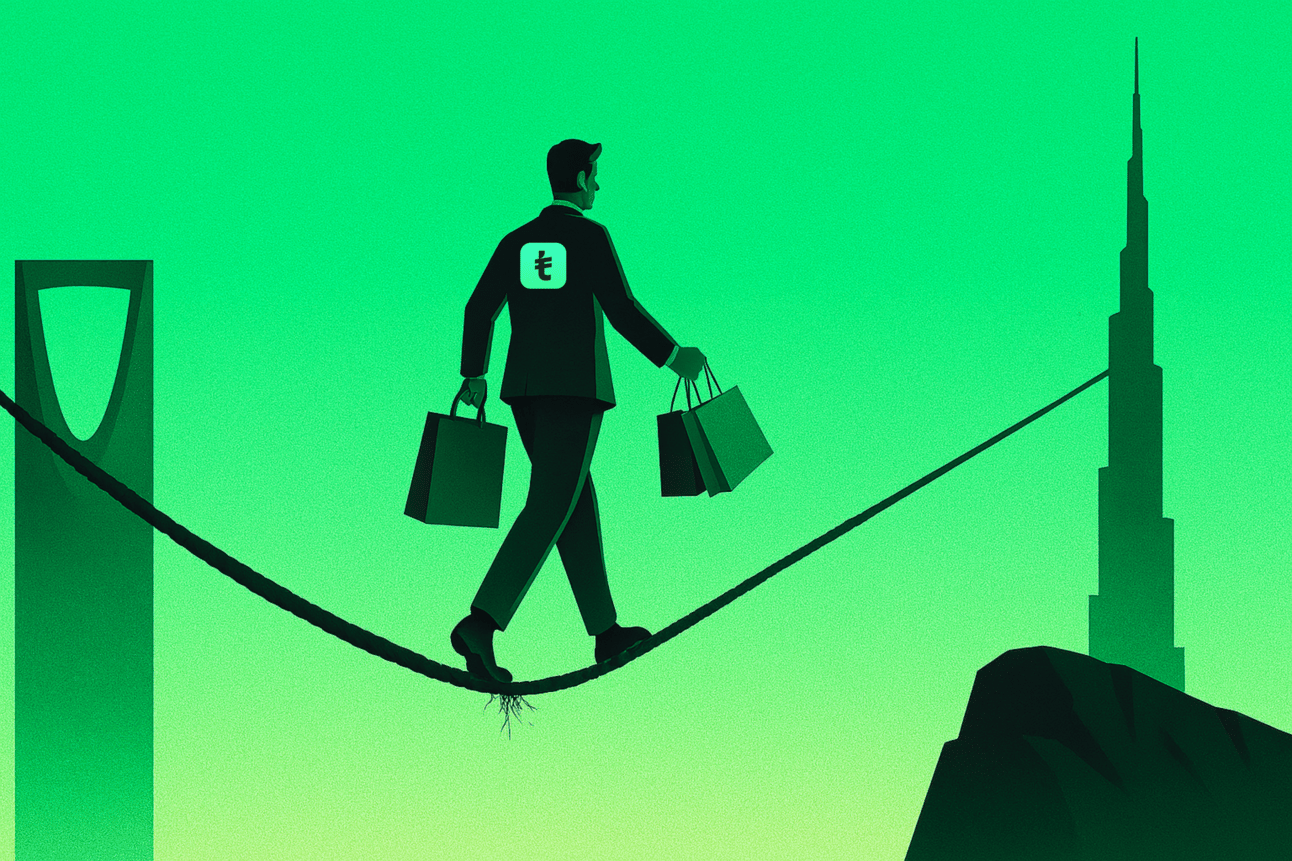

Talabat (H1 2025): Revenue $982m, +35% YoY, GMV $2.4bn, +32%, profitability remains solid at scale. More here.

Yalla Group (Q2 2025): Revenue $84.6m, +4.1% YoY, adjusted net income $39.4m with a 43.2% margin, MAUs +8.8%. More here.

What stands out: Valu and Presight lead on growth, Yalla delivers the strongest margins, Talabat shows the largest scale with healthy unit economics, Jahez stays profitable while navigating Q2 margin softness.

🤖 AI

Creator: Hamad I Mohammed | Credit: REUTERS

🇸🇦 HUMAIN, Saudi Arabia’s national AI company formed by PIF, will launch ALLaM 34B, a foundation model trained from scratch for Arabic language and culture, by the end of August. CEO Tareq Amin confirmed the model powers a full HUMAIN Chat application suite. Developed in secrecy by 40 PhD researchers using proprietary Saudi datasets, ALLaM 34B reportedly marks a significant leap from SDAIA’s earlier versions and forms part of HUMAIN’s broader strategy, spanning sovereign AI models, an AI-native platform stack, and its HUMAIN OS conversational interface.

🇦🇪 Hot on the heels of last week’s Saudi HUMAIN launch, Core42 has made OpenAI’s new open-weight gpt-oss-120B and 20B models globally available via its AI Cloud and Compass API. Enterprises can pick from AMD, Cerebras, Nvidia, or Azure hardware, fine-tune models for chatbots or RAG, and keep deployments under UAE jurisdiction for compliance.

💰 Fintech

💸 Abhi, a YC-backed fintech offering earned wage access, has launched in Saudi Arabia, its second Middle Eastern market after the UAE, following a $200M, three-year partnership with Alraedah Digital Solutions to develop localised financial products. The app lets employees withdraw accrued wages in ~30 seconds via bank transfer or digital wallet, with employers onboarding through a B2B2C model integrated with the Wage Protection System. Pricing is SAR 30–40 per transaction with no subscription fees. The Saudi rollout enters a competitive space with FlexxPay, Mudad + Khazna, and Cairo-based NowPay, which partnered with United International Holding earlier this year.

⚡️ ADX has onboarded Egypt-founded Thndr as the GCC’s first remote retail trading member, giving its users direct access to UAE-listed equities and ETFs without being in the UAE. The partnership is part of ADX’s strategy to deepen cross-border connectivity through initiatives like Tabadul, broaden retail and institutional participation, and enhance market liquidity. For Thndr, it marks an expansion beyond Egypt into one of the region’s most resilient capital markets, with the ability for investors to pay in local currency and gain exposure across MENA.

🌍 International Investments

🇦🇪 Mubadala Capital has backed US-based Tahoe Therapeutics in a $30M round led by Amplify Partners, with participation from Databricks Ventures and others. Tahoe is building Virtual Cell Models i.e. AI-driven simulations mapping up to 1M drug–patient interactions, to develop precision medicines and cut clinical failure rates. The funding will advance Tahoe’s own therapeutic programs and launch a one-partner collaboration model giving a pharma or AI company access to its gigascale Tahoe-100M dataset. Tahoe now plans to scale to 1B single-cell datapoints, creating what it calls the definitive dataset for AI-powered cancer and disease treatments.

With thanks to our sponsor:

This week on VC React, we unpack Alaan’s $48 million Series A, ask if MENA’s expense-management race (Alaan, Qashio, Pluto, Pemo) ends in one winner or vertical fiefdoms, stress-test Salasa’s AI-powered fulfilment thesis, dissect Wuilt’s “free in Egypt” pivot, and dig into Afaq Capital’s landmark secondaries deal for Falak Investment Hub’s portfolio.