Zazu, a digital financial operating system built for African small and medium-sized enterprises, has raised $1 million in pre-seed funding to accelerate rollout in South Africa and Morocco, ahead of a planned pan-African expansion in 2026.

The round includes backing from Plug and Play Ventures as well as fintech operators and founders from Launch Africa Ventures, AUTO24.africa, Paymentology, Chari, Fiat Republic and several founding members of European fintech unicorns such as Qonto and Solarisbank.

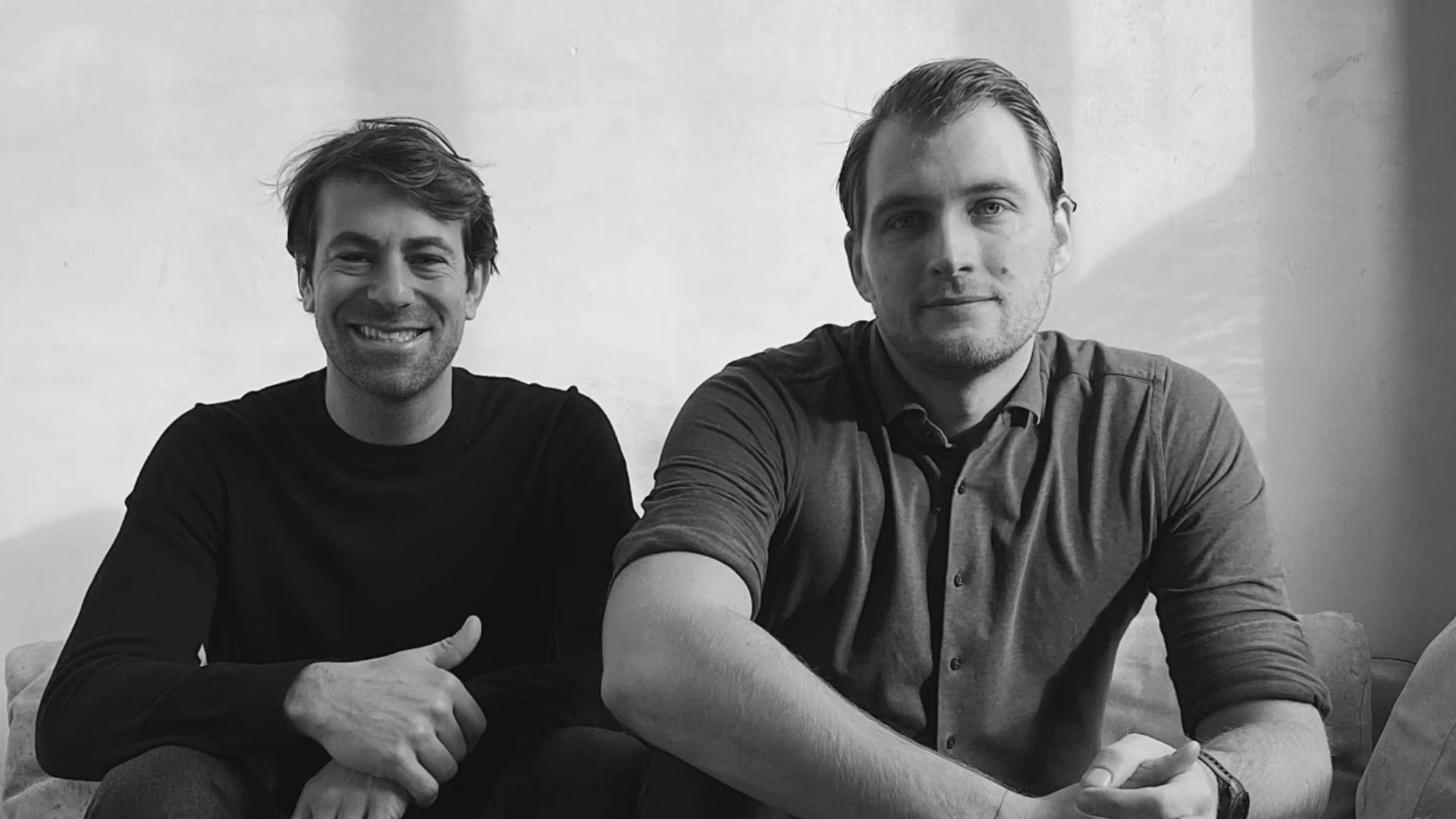

Founded in 2024 by Rinse Jacobs and Germain Bahri, both former employees of Solarisbank, Zazu is positioning itself as a “Mercury-style” banking experience for Africa. More than 50 SMEs are already using the platform in beta, with a waitlist of over 1,000.

Zazu is targeting what economists call Africa’s “missing middle”: the continent’s 50 million SMEs that sit between micro-entrepreneurs served by mobile money and large enterprises supported by commercial banks. This segment faces a financing gap of more than $330 billion, and founders say traditional banks have been slow to modernise workflows for SME needs.

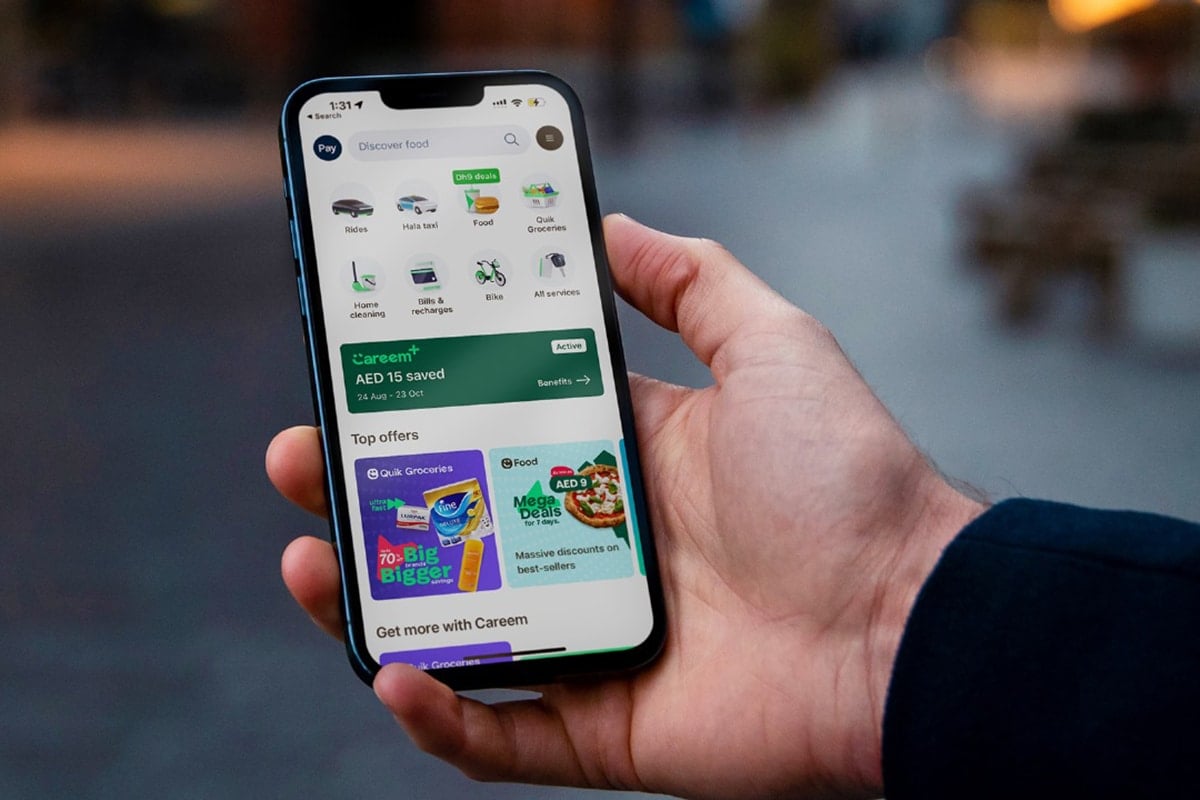

Rather than offering a single-purpose fintech tool, Zazu pitches itself as a rebundled financial OS, integrating accounts, cards and transfers with API-driven links to bookkeeping platforms, tax tools, payroll, HR software, e-commerce systems and payment providers. SMEs can issue physical and virtual cards, assign spending controls and automate tasks such as invoice reminders or cash-flow forecasting.

Zazu also targets Africa’s large informal economy by offering digital business incorporation, enabling unregistered merchants to formalise and access financial services.

Unlike full-stack neobanks, Zazu is not pursuing a banking licence. Instead, it operates a bank-partnership model: in South Africa it works with a licensed commercial bank, while in Morocco it partners with Chari, one of the region’s first API-driven banking platforms.

Zazu generates revenue through subscription tiers, card interchange, deposit interest and commissions from marketplace partners such as lenders and insurers. Integrations are already live with Paystack, Shopstar, Ozow and more than 20 ecosystem partners across both active markets.

The company has gained early visibility after joining the Visa Accelerator Program and is preparing to open its seed round in early 2026 to support wider African expansion.

“We fully intend to be live in various countries and figure out the right way to plug those countries together with a larger network of products,” co-founder Jacobs said.