Happy Friday, friends 👋

We’re coming to you a little later today – bluntly, I forgot to hit the schedule button before jumping on a plane. My bad!

Not far off the eve of Talabat’s one-year anniversary of going public on the DFM, Delivery Hero yesterday announced that Tomaso Rodriguez, CEO for the past six years, will be stepping down and transitioning into a non-executive board member role at the end of November. Since its debut on the DFM late last year, Talabat’s share price is down roughly 35%. More on his successor here.

In more public markets news: Dubizzle will kick off investor roadshows next week ahead of a planned $2BN IPO on the DFM. And in a very interesting scoop from Semafor, the Saudi CMA is informally asking companies planning IPOs to allocate around 30% of their shares to retail investors, a significant jump from the usual 10–20%.

Global fintech players setting up regional outposts in Dubai show no signs of slowing. Wise this week received final approval from the Central Bank of the UAE to operate in the country, while Revolut and Robinhood remain waiting in the wings.

On the funding front, a relatively quiet week overall, with the standout being Chari’s $12M Series A, the largest Series A funding round ever for a Moroccan startup. It comes amid a year of consolidation in the notoriously difficult B2B retail marketplace space, which has seen consolidation of players over the past year with the mergers of Wasoko and MaxAB, as well as ShopUp and Sary.

This and more below 👇

This week’s round-up is a 5 min read:

🚀 Startup funding round-up

Chari (🇲🇦 Morocco), a B2B e-commerce and fintech platform for small retailers, has raised $12M Series A co-led by SPE Capital and Orange Ventures, with participation from Verod-Kepple Africa Ventures, Plug and Play, Endeavor Catalyst, and Pincus Capital, to build Morocco’s first BaaS offering and expand its merchant super app.

Tachyhealth (🇸🇦 KSA), a healthtech company building AI-powered intelligent healthcare solutions, has raised $5M Series A led by Tawuniya Insurance to accelerate adoption of its platform, drive operational efficiencies, and advance value-based care models.

Nanovate (🇪🇬 Egypt), an Arabic-first AI platform offering voice and chat agents, automation systems, and no-code tools, has raised $1M pre-Seed from angel investors to expand into KSA and UAE, deepen CRM integrations, and invest in AI R&D.

PAYDAY (🇹🇳 Tunisia), a fintech and insurtech platform offering salary-backed financing and micro-Takaful protection, has raised an undisclosed pre-Seed round at a $3M valuation, led by UGFS North Africa, with participation from TALYS Group and BioProtection SA, to scale its inclusive financial wellness platform across North Africa.

Recent deep-dives

📊 Chart of the week

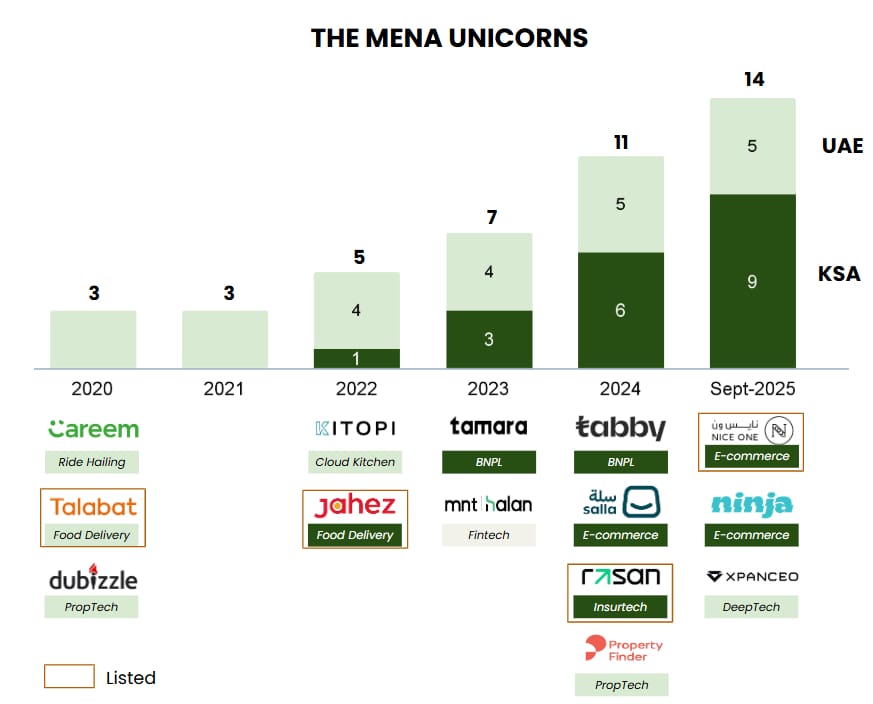

🇸🇦 STV has published an updated analysis of Saudi Arabia’s venture ecosystem, following on from its October 2023 report that identified a $20bn growth-stage funding gap across MENA. At the time, STV warned that the abundance of early-stage capital had not been matched by sufficient growth-stage financing – a critical weakness as the region’s 220+ Series A+ companies matured.

The 2025 update sharpens its focus on Saudi, where $5 billion of VC has been deployed over the past five years, producing nine unicorns that account for 65 % of all MENA unicorns. Yet, relative to GDP benchmarks, unicorn creation and VC deployment remain well below potential. STV now estimates around $16 billion in growth-stage capital is needed to fully unlock the Kingdom’s pipeline, warning that without more Saudi-native growth VCs, the ecosystem risks losing momentum.

💸 VC

🌍 Investcorp has closed its $750 million Golden Horizon Cooperation Fund, launched with China Investment Corporation, to invest in high-growth companies across the GCC and China. The fund targets consumer, healthcare, logistics, and business services sectors, focusing on mature companies with clear paths to IPOs or strategic exits within three to five years. Positioned as a commercial bridge between the Gulf and China, it has already invested in NourNet, TruKKer, and Salla. LPs include Jada Fund of Funds, Saudi Venture Capital Company, Silk Road Fund, and Bank of China.

🇺🇸 AAF Management, the Washington-based venture firm co-founded by Omar Darwazah, an Egyptian-American investor, and Kyle Hendrick, has closed a new $55 million Axis Fund, bringing total assets to about $250 million across four vehicles. Its LP base includes Mubadala Investment Company, U.S. and MENA family offices, and a multibillion-dollar U.S. venture firm. AAF has made 138 direct investments, backed 39 emerging managers, and recorded 20 exits worth nearly $2 billion.

🍔 Food Delivery

🛵 Talabat has announced a leadership transition with CEO Tomaso Rodriguez stepping down after six years at the helm and being succeeded by Toon Gyssels, who will officially assume the role on November 21, 2025. Rodriguez, who led the company through ninefold growth and a record-breaking IPO, will remain on the board in a non-executive capacity. Gyssels previously served as Talabat’s COO and interim CEO, driving its MENA expansion and launching Q-commerce and cloud kitchen verticals.

🇪🇬 Breadfast is stepping further into super app territory with the launch of the Breadfast Card, part of its fintech arm, Breadfast Pay. Led by Gamal Mohie, the initiative was developed in partnership with Visa, Abu Dhabi Islamic Bank – Egypt, and MDP, with regulatory support from the Central Bank of Egypt. The fintech division will offer deposits, withdrawals, and savings accounts to tap into Egypt’s large unbanked and underbanked population, adding another layer to Breadfast’s ambition to build a household-first digital ecosystem. Breadfast has also recently expanded into new verticals like a chef-on-demand service and travel through Journeys by Breadfast.

📈 Public markets

🇦🇪 Dubizzle Ltd. will kick off investor roadshows next week ahead of its planned IPO on the Dubai Financial Market. The classifieds platform plans to offer 30.3% of its share capital (around 1.25 billion shares), with Prosus N.V. committing $100 million. Joint bookrunners include Emirates NBD, Goldman Sachs Group Inc., HSBC Holdings Plc, and Morgan Stanley, while Rothschild & Co. is financial advisor. The IPO, which could value Dubizzle at around $2 billion, comes amid a property boom in Dubai, where the company has expanded its footprint through acquisitions like Drive Arabia, Hatla2ee, and Property Monitor.

🇸🇦 Saudi’s CMA is informally asking companies planning IPOs to allocate around 30% of their shares to retail investors, up from the usual 10–20%, according to Semafor. The push is part of wider efforts to boost liquidity and revive trading volumes on the Saudi exchange, alongside measures like scrapping Qualified Foreign Investor registration rules and potential changes to the 49% foreign ownership cap. Retail investors made up over 20% of buy and sell orders in September, and regulators see larger retail allocations as a way to drive post-listing activity.

💰 Fintech

🏦 Wise has received final approval from the Central Bank of the UAE to operate in the country, securing licences for Stored Value Facilities and Retail Payment Services – Category 2, paving the way to launch its Wise Account and Wise Business products for individuals and companies. While the licence covers both domestic and international transfers, Wise is awaiting an additional no-objection approval to offer remittances under new CBUAE rules.

🇦🇪 Speaking on the sidelines of the FinTech Forward event in Bahrain, Konstantinos Adamos, Revolut’s group head of legal and non-executive director of Revolut Digital Assets, said the company is “working diligently towards a launch in the UAE,” where it plans to issue cards and offer domestic and cross-border remittances, according to reporting from The National. Revolut sees an opportunity to compete on low fees and brand trust in a crowded remittance market. The company is also exploring Arabic language support to localise its product.

🤖 AI

🇸🇦 Tabby is deploying NVIDIA HGX systems in Saudi to build its own AI infrastructure, a move that positions the fintech to localise compute and comply with regional data rules while scaling its product capabilities. The company plans to use the systems to support AI models in customer service, fraud detection, risk scoring, and shopping personalisation. Hosting the infrastructure locally is intended to cut latency and give Tabby more control over sensitive financial data.

🏠 Proptech

🇦🇪 Stake has launched StakeOne, a new product that lets anyone globally buy, manage, rent, and sell full properties through one app, expanding beyond fractional ownership. At launch, it features curated top 1% listings from partners including Emaar Properties, Ellington Properties, and Dubai Holding. Since 2021, Stake has surpassed AED 1.3 billion in transactions, and grown to over 1 million users. It’s regulated by the Dubai Financial Services Authority and the CMA in Saudi, and backed by Mubadala Investment Company, Wa’ed Ventures, MEVP, and Republic.com.