We have WhatsApp rumours, disparate press releases, and vague promises of "market readiness."

We’ve got databases for every seed round. We’ve got endless headlines on valuation spikes. And we’ve got plenty of speculation on who the next unicorn might be.

What we don’t have is a centralised source of truth for the graduating class of MENA tech.

The narrative has shifted. The Tadawul is no longer just a theoretical alternative to the Nasdaq; for many, it is the destination. The Dubai Financial Market and ADX are actively courting local champions. We are fast approaching a "golden window" where the region's most mature companies should finally face the public markets.

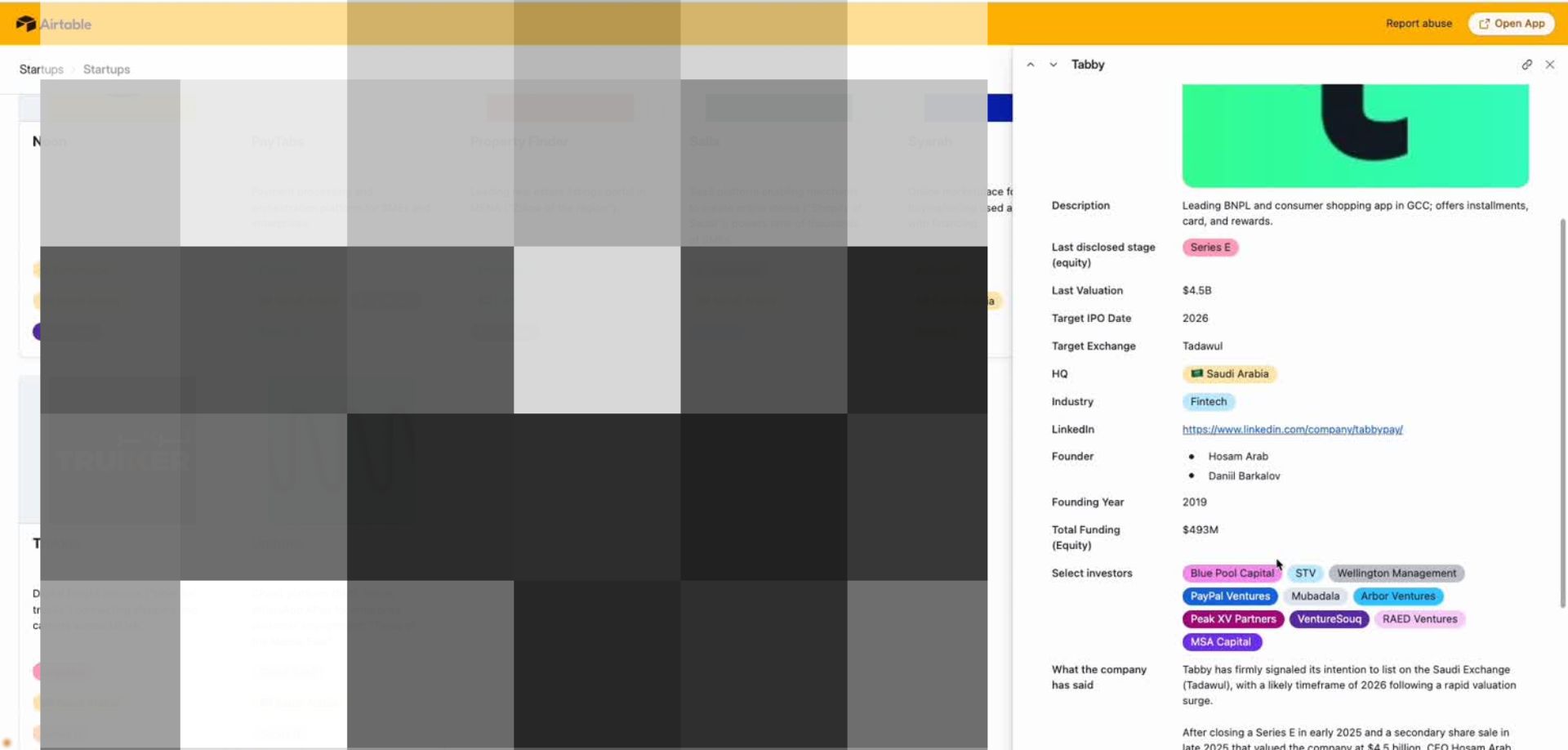

Hosam Arab’s Tabby, reshaping how the region accesses credit and preparing for a landmark listing. Mohamad Ballout’s Kitopi, the cloud kitchen giant waiting for the right liquidity moment. Abdulmajeed Alsukhan’s Tamara, quietly securing the debt facilities needed to support a public loan book. Abdulaziz B. Al Loughani’s Floward, hiring the banks and setting the stage.

The pipeline for 2026 through 2028 is incredibly dense, yet the information remains frustratingly opaque, buried in interview footnotes, regulatory filings, and "market chatter."

So, we’ve built the MENA Tech IPO Tracker.

This is designed to be a living, dynamic directory of regional companies earmarked to go public. We’ve collated the target exchanges, the last known valuations, the appointed banks, and the key quotes from leadership.

How we selected the companies

While "market chatter" is part of the ecosystem, this tracker is a curated selection of companies that have moved beyond speculation and into execution.

We selected these companies based on clear, observable signals of public market readiness:

Explicit intent: The company has formally announced IPO plans, or leadership has gone on record (in press or investor updates) confirming a listing timeline.

Operational maturity: These aren't seed-stage bets. We focused on companies at Series B or beyond, with significant capital raised (typically >$100M) or valuations approaching/exceeding "unicorn" status.

Tangible preparation: We looked for the "boring" but critical milestones i.e. hiring investment banks as advisors, converting to a joint-stock company structure, or releasing "pre-IPO" funding announcements.

Regional commitment: The primary listing destination is a MENA exchange (Tadawul, DFM, ADX). While some may consider dual listings, the anchor is local.

This criteria will evolve. As companies delay plans (a common occurrence) or new contenders emerge from the woodwork, so will this list.

To support that evolution, we’ve built this as a living directory. It tracks not just who is listing, but when (target date), where (exchange), and how much they are worth (valuation), updated as new filings and announcements hit the grapevine.

What the tracker shows us

A few immediate takeaways from the inaugural dataset:

The Saudi gravity: If there was any doubt about where the centre of gravity lies for exits, this data settles it. Over 70% of the tracked companies are headquartered in Saudi Arabia or listing on the Tadawul. The Kingdom’s push to deepen its capital markets is working; for late-stage tech, Riyadh isn't just an option, it is the default destination.

The "Golden Window" (2026–2027): While we have seen a few listings in recent years, the pipeline is bunching up heavily around 2026 and 2027. A significant portion of the companies have signalled these years as their target, suggesting we are approaching a historic period of liquidity for the region's early VCs.

Fintech is king: Just as with early-stage funding, fintech dominates the pre-IPO pipeline, representing nearly a third of the list. From payments to lending, the sector is maturing faster than any other vertical.

The "local" multinational: Interestingly, we are seeing global models adapting for local exits, proving that MENA exchanges are becoming viable exit routes for international tech assets with strong local footprints.

The MENA Tech IPO Tracker

Here's our list of likely prospects, and their outlook for an IPO. We'll update it regularly, tracking companies' plans and progress.

The MENA Tech IPO Tracker is for premium subscribers.

To celebrate the launch, we’re offering a steep limited-time secondary discount of 25% off all plans 👇

As a premium subscriber you’ll also get access to new analysis and case studies published weekly, unlock all past deep-dives (60+ pieces), exclusive interviews with leading MENA-based founders and VCs, and our exclusive MENA founder and VC playbooks.

Plus, you’ll be supporting an independent regional tech publication that actually gives a sh*t!