🔓 Unlock the full article with a premium subscription.

The math behind healthcare is broken, and nowhere is this more apparent than in the Gulf, where the combination of near-universal insurance coverage, abundant disposable income, year-round air conditioning, and an unrelenting food delivery ecosystem has produced one of the least healthy populations on the planet.

Chronic conditions now account for roughly two-thirds of deaths globally, which is grim enough, but the more unsettling statistic is that something like 80% of these are preventable through lifestyle changes (the kind of interventions that sound simple on paper and prove maddeningly difficult to implement at scale).

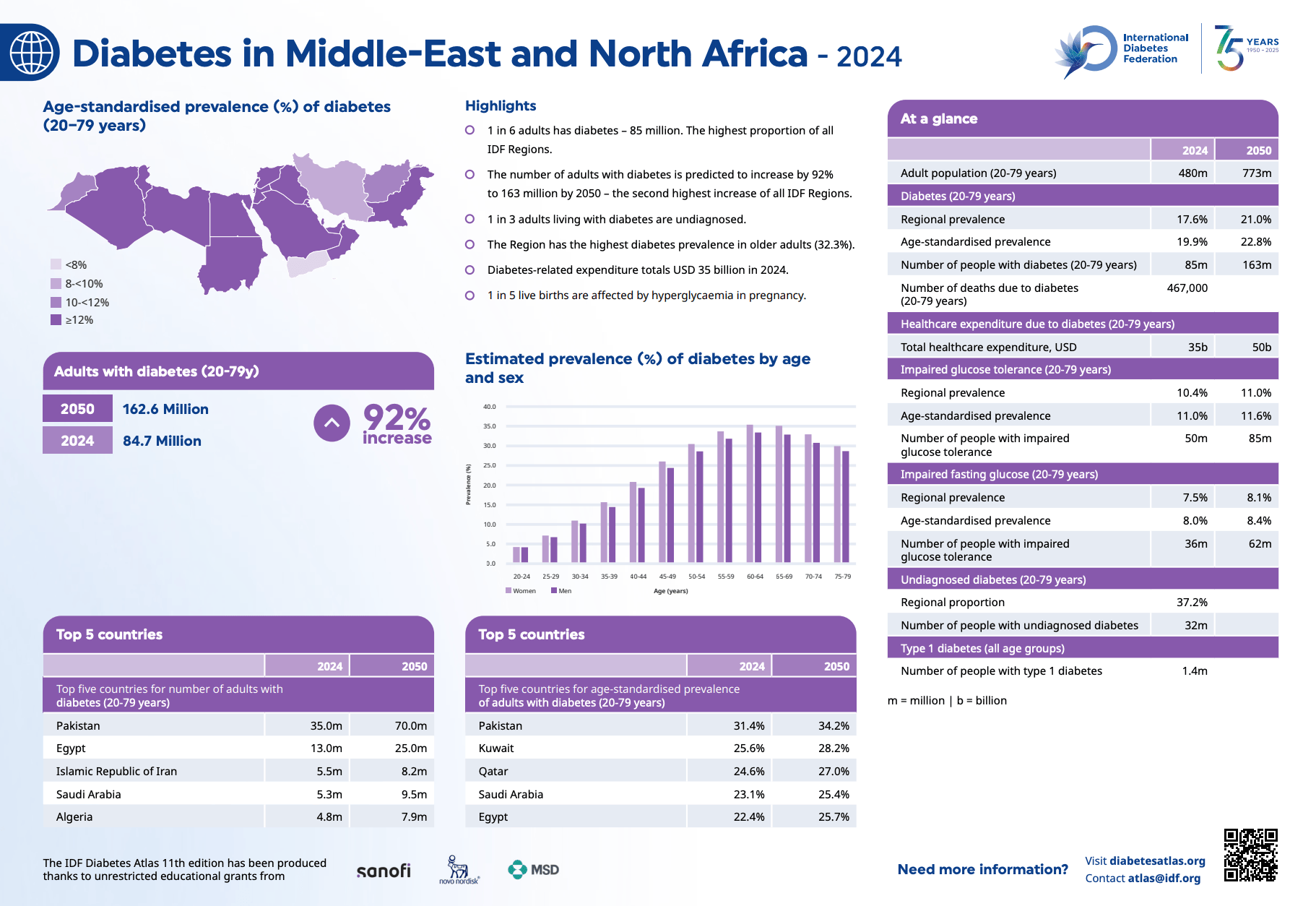

The MENA region is on track for NCDs to cause 81% of all deaths by 2030, the Gulf already attributes three-quarters of its fatalities to chronic disease, and the region carries the highest diabetes prevalence in the world, a figure expected to nearly double by 2045, which suggests that whatever we're currently doing isn't working.

The traditional response has been to throw infrastructure at the problem: more hospitals, more doctors, more beds, more treatments. But the region faces structural constraints that make this approach somewhere between impractical and delusional. MENA has 1.7 physicians and 1.9 hospital beds per thousand people, compared to 3.34 and 4.8 respectively in OECD markets.

You cannot hospital-build your way out of a lifestyle disease epidemic, particularly when the pipeline of medical professionals takes a decade to produce results and the epidemic is compounding annually.

This creates what Global Ventures, in their excellent 2025 Digital Health in MEA report, diplomatically terms a "pivotal moment": the opportunity to transition from reactive, disease-treatment healthcare to proactive, preventative care, "leapfrogging ahead in a market unencumbered by legacy infrastructure and avoiding the unsustainable escalation of healthcare costs seen in other markets."

Translation: the Gulf doesn't have a century of entrenched hospital systems and fee-for-service incentives to untangle, which means it might actually be easier to build something new here than to reform what exists in the US or Europe.

Governments, to their credit, have noticed.

The UAE now offers free diabetes screening with same-day physician consultations. Saudi Arabia is funneling Vision 2030 money into everything from smoking cessation programs to longevity research, with the Hevolution Foundation alone committing up to a billion dollars annually to biotech startups trying to slow biological aging (which is either visionary or hubristic depending on your tolerance for moonshots).

PureHealth wants to turn Abu Dhabi into a "blue zone," the kind of place where people live longer not because they're rich but because the system is actually designed to keep them healthy.

Whether any of this works remains to be seen, but the intent is clear: the $80 billion annual productivity drain from chronic disease in the GCC has made prevention a policy priority rather than a nice-to-have.

The demand side, for once, appears to be ready. Philips research from 2023 found that 88% of UAE respondents want to take greater control of their health and wellbeing, a shift widely attributed to the pandemic making everyone suddenly, viscerally aware of their own mortality.

Meanwhile, 64% of UAE consumers say they're willing to pay more for products that support their health. Whether stated preferences translate into actual behaviour change is, of course, the eternal question, but the sentiment is there.

The supply side, particularly insurance, has been considerably slower to respond.

Insurance penetration in MENA sits at just 2-3% of GDP, well below the global average of 7%, and the sector has historically been dominated by commercial lines (property, liability, marine) with personal insurance treated as something of an afterthought.

Fintech has attracted billions in regional investment over the past half-decade; insurtech remains the unloved sibling, with funding dropping from $40.7 million across 13 deals in 2021 to a rather anaemic $18 million across six deals in 2022.

The sector has not, it's fair to say, inspired confidence.

The fundamental challenge is that insurance and wellness operate on opposing logics. Insurance is designed to be invisible: you buy it, forget about it, and hope you never need it. Wellness requires daily engagement, the slow accumulation of small decisions that compound over years.

These two models seem almost deliberately incompatible, until you realise that the underlying economics actually align rather neatly: if insurers can keep policyholders healthy, claims drop; if claims drop, margins improve; if margins improve, everyone from shareholders to regulators is happy.

The question is whether anyone can build a product that makes prevention engaging enough to actually change behaviour at scale, and whether the insurance industry, which has never been accused of moving fast or breaking things, is capable of adopting it.

Vaibhav Kashyap and Javed Akberali

Enter Wellx.

Founded in 2022 by Vaibhav Kashyap and Javed Akberali, the UAE-based platform raised a $2 million seed round in July 2023 led by Dubai Future District Fund, with participation from DASH Ventures, Sanabil 500, and Plug and Play Ventures.

Rather than competing with legacy insurers (a strategy that has historically ended poorly for startups with limited capital and no actuarial track record), Wellx partners with them, providing the engagement layer, the wellness infrastructure, and increasingly, the data to prove that prevention actually works.

In this conversation, we sat down with both co-founders to understand how they're attempting to flip the insurance model from sick care to prevention, why the region's broker-dominated distribution system is both their biggest obstacle and their biggest opportunity, and what it takes to build a company in a sector where even Buffett, Bezos, and Dimon (three of the most competent capital allocators in modern history) tried, failed, and gave up.

Stay ahead in MENA’s tech landscape

This is premium content. Subscribe to read the full story for less than $0.27 per day.