Happy Friday, friends 👋

It’s one of those weeks where it’s hard to know where to begin. So, let’s start where we can offer the most value and insight.

With Permira and Blackstone acquiring a minority stake in Property Finder for $525 million, we’re thrilled to feature a piece from Amir Farha (now founder and managing partner at COTU Ventures, and formerly co-founder and managing partner at BECO Capital, the company’s first institutional investor). Amir offers a candid reflection on how venture returns are won, or lost, in the final stretch, using Property Finder and Careem to show how compounding and timing decide whether funds generate liquidity or leave multiples on the table. It’s a terrific read, and we’re grateful to Amir for letting us share it here.

If you’re curious about Orbii, the AI-powered embedded lending platform that announced a $3.6M Seed round this week, look no further than our exclusive interview with CEO and co-founder Nauman Ali. We dig into how early experiences shaped the mission, why defaults can fall close to zero, and what a post–credit score world might mean for businesses across the region.

And on the eve of Money20/20 in Riyadh next week (we’ll be there, so please do say hello 👋), Revolut securing UAE Central Bank approval will no doubt be a hot topic, with debates already circling on whether it’s a boon or a blow for local fintechs.

Jordanian founder Amjad Masad’s Replit just raised $250M at a $3B valuation and launched Agent 3 to rave reception, while commerce super-app Noon is reportedly eyeing a dual Saudi–UAE listing at around $10B within two years, according to founder Mohamed Alabbar’s comments to the FT.

In fund news, anb Capital and Lexham Partners have launched a $200M vehicle for growth and pre-IPO firms in MENA, VentureSouq closed its second fintech fund, and a UK biotech investor is preparing to deploy $50M into companies with strategic ties to Saudi Arabia and the wider region. As for startup funding, we’ll leave that to our roundup below.

To avoid getting cut off, we recommend reading this one online 👇

This week’s round-up is an 10 min read:

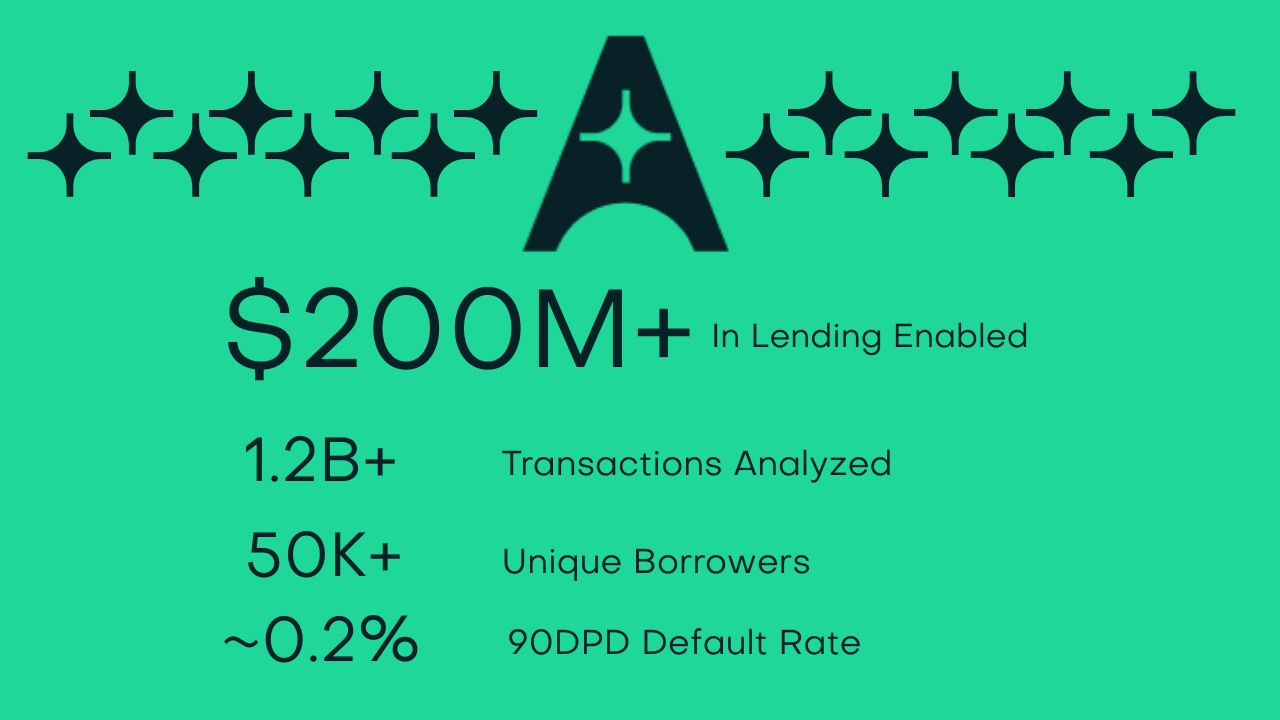

We previously covered AdalFi’s approach to Smarter Credit Decisions and Instant Lending Rails: AI models using deposit-account data to underwrite overlooked consumers and SMEs, delivered through the Assess → Activate → Disburse → Optimise lending loop.

Today’s update: AdalFi has crossed $200M+ in disbursements with a 0.2% 90-DPD default rate across 50,000+ unique borrowers and repayment events, evidence that banks can scale credit safely when decisions are grounded in transactional signals.

What’s new:

Senior hires, MEA growth: Ian Read (Head of Credit Excellence; ex-FICO, SIMAH, Qarar, Principa, Experian; 50+ countries) and Emre Ünlüsoy (Head of Sales, MEA) join to accelerate partner deployments and regional scale.

Aligned incentives: AdalFi operates on Shared Revenue, Shared Risk, sharing upside when loans perform and sharing loss proportionally, keeping growth and prudence aligned.

🚀 Startup funding round-up

CredibleX (🇦🇪 UAE), an SME digital lender that provides receivables financing, payables financing, and short-term loans via embedded partnerships, has secured a $100M senior secured credit facility from Pollen Street Capital.

TERN Group (🇦🇪 UAE / 🇬🇧 UK), an AI-powered healthcare workforce platform, has raised $24M in Series A funding led by Notion Capital and EQ2 Ventures, with backing from RTP Global, LocalGlobe, Leo Capital, Presight Capital, and DST Global’s Tom Stafford.

PRYPCO (🇦🇪 UAE), a proptech startup pioneering tokenised real estate founded by Amira Sajwani, has secured an undisclosed pre-Series A round led by General Catalyst, its first proptech bet in the Middle East.

orbii (🇦🇪 UAE), an AI-powered embedded lending platform that enables banks, fintechs, and B2B ecosystems to launch and scale SME credit products, has raised $3.6 million in seed funding, led by Prosus Ventures with participation from VentureSouq, DASH Ventures, Taz Investments, and Sanabil 500.

Metric (🇦🇪 UAE), an AI fintech startup that provides SMEs with real-time financial intelligence via its AI co-pilot “Max.”, has raised a round led by A-typical Ventures, with participation from 500 Global, Hub71, i2i Ventures, Plus VC, Epic Angels, Oqal Angels, and others.

Fitting (🇸🇦 KSA), a contech marketplace linking suppliers with developers, has raised $500K in pre-seed funding from a strategic angel investor.

21Doctors (🇸🇦 KSA), an Arabic-first AI healthcare platform, has closed a pre-seed round with angel investors.

DawaDose (🇸🇦 KSA), a digital pharmaceutical platform, has raised a pre-seed round from angel investors to launch an integrated B2C/B2B ecosystem. s.

New deep-dives

🏠 Proptech

🏠 Permira and Blackstone have invested $525M for a minority stake in Dubai-based Property Finder, one of the region’s largest real estate classifieds platforms. The deal, which included a partial exit for General Atlantic, is Permira’s first regional investment after opening a Dubai office, while Blackstone has also stepped up its dealmaking in the Gulf. Property Finder, valued at over $1B after a debt raise last year to buy out early backer BECO Capital, generated a $80M+ return for BECO LPs, a 1.6x fund return with carried interest for GPs, according to Amir Farha, and now plans expansion into Saudi Arabia and Turkey amid Dubai’s surging housing market.

💰 Fintech

📱 Revolut has secured in-principle approval from the UAE central bank for stored value and retail payment licences, clearing the way for its launch in the market. The London-based fintech, now at 60M+ customers globally and valued at $75B, is building a local team under Ambareen Musa, former Souqalmal founder and Revolut’s GCC CEO. The UAE rollout follows expansions into Australia, Brazil, Mexico, Japan, Singapore, the US, and India, with Revolut aiming to rank among the top three financial apps in each market.

📑 Saudi Arabia’s Capital Market Authority has approved rules that let licensed investment firms run crowdfunding platforms for sukuk and other debt instruments. Until now, such offerings were only possible under a temporary FinTech sandbox; they will now be part of the formal capital markets regime.

📈 Public markets

🛒 Noon, the Saudi-backed e-commerce platform founded by Mohamed Alabbar, is eyeing a stock market listing within two years, potentially dual-listed in Saudi Arabia and the UAE at a valuation near $10B. The company, which employs 40,000 drivers across Saudi, the UAE, and Egypt, is pushing toward profitability. Analysts put its 2024 GMV at $5–6B, though low basket sizes and heavy grocery investment continue to pressure margins. Noon is also exploring M&A and an entry into India, as it faces stiff competition from Amazon, Shein, Ikea, and Meituan’s Keeta in food delivery.

🚌 Cairo-born mobility firm Swvl has reported a turnaround in H1 2025, posting a $0.43M profit before tax after a $5.7M loss a year earlier, with revenue up 26% YoY (49% in constant currency). The Nasdaq-listed company, which restructured and exited markets in recent years, is rescaling through strong gains in Saudi (revenue +80%, margins +112%) and Egypt (+29%), alongside a new UAE launch that generated $0.86M. Swvl says it will focus on margin expansion, cost optimisation, and scaling across the GCC, UK, and US while pushing toward more stable, recurring revenue streams.

🍔 Shares of Saudi food delivery platform Jahez hit an all-time low of SAR 20.82 on Sept 10, down 1%. The slide follows a $40M Sharia-compliant credit facility from the National Bank of Bahrain to fund new HQ capex and a 22% YoY drop in Q2 net profit to SAR 23.6M. Jahez is also expanding through a $245M acquisition of Qatar’s Snoonu, even as margins remain under pressure.

🤖 AI

💻 Jordanian founder Amjad Masad’s Replit has raised $250M at a $3B valuation, led by Prysm Capital with participation from Amex Ventures, Google’s AI Futures Fund, and existing backers including YC, a16z, and Coatue. Founded in 2016 by Amjad and Faris Masad with Haya Odeh, Replit is an AI-first platform that lets users build, deploy, and collaborate on full-stack apps directly from the browser. The company has now raised ~$478M in total, with annualised revenue surging from $2.8M to $150M in under a year. Alongside the raise, Replit unveiled Agent 3, its most autonomous agent yet, capable of testing apps in real browsers, auto-fixing code, and generating custom automations.

🤝 Acquisitions

📦 Moroccan super-app Ora Technologies has acquired last-mile delivery platform Cathedis for an undisclosed sum. Founded in 2023 by Omar Alami, Ora bundles payments, marketplace, delivery, chat, and social into one app; its Kooul food delivery arm has signed 15K+ active clients in under a year, while its wallet Ora Cash has reached 50K accounts in five months. The $7.5M Series A it raised in July was earmarked for logistics and digital cash collection, now accelerated by Cathedis’ acquisition, which gives Ora greater end-to-end control from payments to doorstep delivery.

💸 VC

💰 anb Capital, the investment arm of Arab National Bank, and London-based Lexham Partners have launched a $200M fund for growth and pre-IPO stage tech firms in MENA, with Saudi Arabia as its main focus. It will invest through a mix of equity and secondary deals, targeting scalable platforms aligned with Vision 2030’s digital agenda. Lexham’s Dominic Perks, who co-founded Hambro Perks and the $50M Oryx Fund in 2021, stepped down from Hambro in April 2023; the firm rebranded as Salica Investments the following year, after which Perks set up Lexham with Sanjiv Somani, the former chief executive of Chase UK.

📊 UAE-based VentureSouq has closed its second fintech vehicle, FinTech Fund II, with backing from heavyweight LPs including Jada Fund of Funds (PIF-owned), SVC, Saudi Awwal Bank, Mubadala, Takamol, Krafton, and Jordan’s ISSF. The fund will target early-stage fintech and SaaS companies across MENA, with a focus on payments, alternative credit, digital banking, proptech, insurtech, and personal finance. VentureSouq, which manages ~$250M and has invested in 200+ companies globally, has previously backed Tabby, Huspy, Yassir, Salla, and Mozn.

🧬 Sarat Ventures and Y Innovations have launched a UK-based biotech fund anchored by Allocator One, set to deploy ~$50M into companies with strategic ties to Saudi Arabia and the wider MENA region. The fund will focus on advancing early scientific concepts into therapeutics and leveraging Saudi Arabia’s infrastructure to support Vision 2030 goals, with the Kingdom’s biotech sector projected to hit $11–12B by 2030.

🇹🇳 Tunisian VC firm 216 Capital has partnered with Silicon Valley’s Plug and Play to launch the 216 Capital Venture Accelerator, a six-month programme for up to 20 startups. Each participant will receive about $58K in funding, with potential follow-on for top performers. The initiative is backed by Smart Capital and the ANAVA fund of funds.

Meet AdalFi at Money20/20 Middle East (Riyadh, Sep 15–17) — Booth H1.U91

Daily at the booth: Ian Read will run short sessions on how lenders can extend credit to SMEs at scale, reaching 10× more qualified borrowers without drift in risk, using AdalFi’s Credit Intelligence (transaction-level affordability, income stability, employer signals, and champion/challenger frameworks) within a platform built to assess, activate, disburse, and optimise with continuous back-/stress-testing.

Day 3 — Sep 17, 4:00 PM: CEO Salman Akhtar joins the panel “The Future of SME Finance: Intelligent Infrastructure, Inclusive Growth.”

“If you care about AUC lift, cycle stability, and audit-ready explainability, let’s compare notes.” — Ian Read

🌍 International Investments

🔬 Qatar Investment Authority has joined BlackRock, Temasek, Baillie Gifford, and others in PsiQuantum’s $1B Series E, valuing the US-based quantum computing firm at $7B. PsiQuantum is developing a million-qubit photonic quantum computer using semiconductor fabrication and photonic chip technology.

🪑 CE-Invests, the investment arm of Crescent Enterprises, has joined Panthera Growth Partners and SMBC Asia Rising Fund in a $50M Series C for Flipspaces, a tech-first interior design and build firm. Founded in 2015, Flipspaces uses AI-driven software to design commercial spaces and plans to expand across India, the US, and the wider MENA region via the UAE.

💹 Abu Dhabi-based Phoenix Venture Partners has invested in Wahed, the global Islamic fintech platform serving 300,000+ clients across 11 offices and nine licensed jurisdictions. PVP first joined during Wahed’s Series B and will continue supporting the company across product launches, upcoming fundraising, and IPO readiness.

With thanks to our sponsor:

This week on VC React, we debate Qatar’s $13B stake in Anthropic, test Munify’s play for the $30B Egyptian remittance market, and break down Intella’s Arabic digital human, Ziila.