Happy Friday, friends 👋

Before we get into this week’s edition, a quick announcement. We’re incredibly excited to be launching a new project that we’ve been working on behind the scenes for the last few months this coming Monday. We won’t spoil the surprise, but the long and the short of it is that you can expect to receive 3 editions of FWDstart in your inbox every week moving forwards. We hope you enjoy it as much as we’ve enjoyed building it!

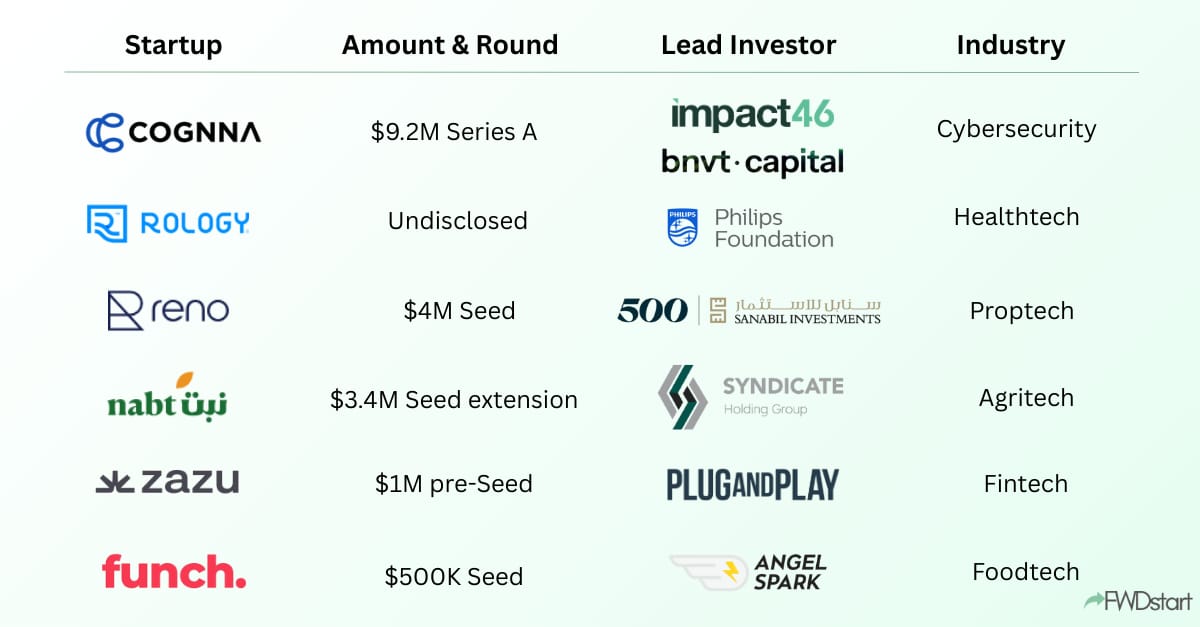

Leading the funding announcements this week is Saudi based cybersecurity startup Cognna with a $9.2M Series A led by Impact46 and BVNT Capital. Having watched founder and CEO Ziyad Alshehri pitch at the Google for Startups Cybersecurity Accelerator demo day in Abu Dhabi last week, we’re not surprised.

Elsewhere, for the second week on the bounce, there’s a really great diversity of sectors funded. From tech driven home renovation platform Reno, to agritech startup Nabt which is modernising fresh produce supply chains, to Zazu, a Moroccan platform providing Mercury style banking for African SMEs.

One of the biggest standouts this week is the news that Kalshi continues its remarkable ascent under Lebanese founder Tarek Mansour. The prediction platform has catapulted to an $11B valuation, more than doubling in under 2 months. This of course will come as no surprise to readers of our MENA Diaspora 50.

We round things out by also taking a look at Saudi BNPL behemoth Tabby’s Q3 earnings and digging into the detail.

P.S. we’ll be attending Abu Dhabi Finance Week from Monday. If you’re going to be there on the ground, feel free to give Jamie a shout.

This and much more below 👇

This week’s round-up is a 5 min read:

🚀 Startup funding round-up

COGNNA (🇸🇦 KSA), a cybersecurity startup building an AI-driven "agentic SOC" platform for automated threat detection and response, has raised $9.2M Series A led by Impact46 and co-led by BNVT Capital, with participation from Vision Ventures and tali ventures, to accelerate global expansion, scale engineering and SOC teams, and advance its AI-led SecOps capabilities.

Reno (🇦🇪 UAE), a tech-driven home renovation platform integrating design, project management, contractor oversight and "Renovate Now, Pay Later" financing into a single end-to-end system, has raised $4M in equity and debt from Sanabil 500, Hub71, Plus VC, Zero 100 VC, FlyerOne Ventures, Sandstorm VC, AngelSpark and Swiss Founders Fund, to expand across the GCC, scale technology capabilities and launch an AI-powered design app in early 2026.

Nabt (🇸🇦 KSA), an agritech startup modernising fresh-produce supply chains through B2B marketplace infrastructure, online auctions and real-time market intelligence, has raised $3.4M Seed extension led by SHG Group with continued participation from Merak Capital, bringing total funding to $5M, to expand into additional Saudi cities, broaden its produce portfolio and scale fulfilment operations nationwide.

Rology (🇪🇬 Egypt), an AI-assisted teleradiology platform connecting hospitals with remote radiologists, has closed a growth round with participation from Philips Foundation, Johnson & Johnson Impact Ventures, Sanofi Global Health Unit's Impact Fund and MIT Solve Innovation Future, to expand across MEA, deepen its Saudi presence and increase diagnostic access in underserved markets.

Zazu (🇲🇦 Morocco / 🇿🇦 South Africa), a digital financial operating system providing "Mercury-style" banking for African SMEs, has raised $1M pre-Seed from Plug and Play Ventures, Launch Africa Ventures, Paymentology, Chari, Fiat Republic, AUTO24.africa and founding members of Qonto and Solarisbank, to accelerate rollout across South Africa and Morocco and prepare for pan-African expansion in 2026.

Funch (🇦🇪 UAE), an AI-native lunch subscription startup offering credit-based daily meal delivery for AED 19 with zero delivery fees, has raised $500K pre-Seed led by Angelspark, with participation from Mostafa Kandil (Swvl founder), Mahesh Murthy and others, to scale operations across Dubai and develop its demand forecasting and route optimisation systems.

Recent deep-dives

💸 VC

🇸🇦 Early-stage investor Plus VC plans to fund more than three dozen startups in 2026 as it steps up deployment to about $10 million, more than double this year, with a growing emphasis on Saudi Arabia, now the region’s largest market by funding volume. Speaking to Bloomberg, founder Hasan Haider said the firm, which has backed 250+ startups across 15 MENA countries, will target sectors like construction tech, food-waste solutions and fintech, and will begin raising its next fund in 2026. Plus VC has already invested in Saudi companies including Calo, which is eyeing a 2027 listing, and cooling-tech startup Strataphy.

🗺️ Diaspora

📈 Lebanese founder Tarek Mansour’s prediction-market startup Kalshi has raised $1 billion at an $11 billion valuation, doubling its value in under two months after a prior $300 million round at $5 billion. The round was led by Paradigm with participation from Sequoia Capital, Andreessen Horowitz, CapitalG and other return investors. While Kalshi gained prominence around the 2024 US election, most trading volume now comes from sports, and the company is preparing a partnership with CNN while expanding into corporate hedging for risks like weather and government shutdowns. Rival Polymarket is reportedly raising at a $12–15 billion valuation.

💰 Fintech

📊 Tabby reported USD 104.1 million in Q3 2025 revenue, up 54% year over year, according to analysis shared by Jawlah. It is not yet clear whether these results reflect Tabby’s full regional footprint or are specific to Saudi Arabia, though Jawlah’s analysis appears to focus primarily on the Saudi market. Growth was driven by an expanding merchant network, a larger active user base and continued uptake of Tabby’s instalment and payments products. Net profit reached USD 15.7 million, reflecting improved revenue quality and more efficient cost management.

💸 UAE-based Zest Equity has secured a Financial Services Permission from ADGM’s FSRA, enabling it to offer regulated escrow and distribution services as it builds a unified digital infrastructure for private-market transactions. The platform replaces manual deal workflows with end-to-end digital execution tools, including SPV setup and escrow, allowing capital to move more efficiently across jurisdictions. Zest has already digitised more than $210 million across 160 transactions, backed by investors such as Prosus Ventures, Morgan Stanley, MEVP and the Dubai Future District Fund.

📌 Egypt’s Fawry has set up Fawry Holding for Financial Investment, a new FRA-approved entity that will consolidate all subsidiaries and support the company’s expanding investment activity. The holding company launches with EGP 50M ($1M) authorised capital and EGP 5M ($105K) paid-in, with Fawry owning 99.99%. The structure is designed to streamline operations, simplify restructuring, and enable future acquisitions and new ventures as Fawry pursues long-term growth.

🌍 International investments

💧 UAE’s Mubadala Investment Company has co-invested in South Korea’s NanoH2O, a global provider of reverse osmosis membranes used in desalination and brackish water treatment, alongside Glenwood Private Equity and other investors. NanoH2O, recently carved out of LG Chem and headquartered in Seoul, offers energy-efficient membrane technology that has become the preferred alternative to thermal desalination and generates more than 95% of its revenue internationally. Mubadala said it plans to support NanoH2O’s international expansion, particularly as demand for low-energy desalination grows across MENA.

📈 Public markets

FII Priority Asia/Media Gallery

🌍 Airtel Africa’s mobile money arm, AMC, is preparing a multi-billion-dollar IPO in H1 2026 — with Bloomberg/IFR reporting that the UAE is a leading candidate for the listing – as the business builds on years of rising Gulf backing, including a $200M investment from Qatar’s QIA in 2021 and earlier injections from Mastercard and TPG’s Rise Fund. AMC, which operates mobile money services across 14 African markets and recently converted its Dubai presence into a subsidiary, could list via a PJSC conversion or dual-listing structure, with analysts valuing the business at roughly $8B. QIA holds a minority stake with board rights after its 2021 deal at a $2.65B valuation, while Abu Dhabi’s Chimetech Holding also owns 2%, positioning AMC as one of the most regionally integrated African fintechs ahead of its planned flotation.

📈 Saudi Exchange CEO Mohammed Alrumaih says the bourse has a “very vibrant” IPO pipeline for 2026, with 40 companies already approved by regulators and a further 80–100 appointing advisers – positioning Tadawul to become the region’s dominant listing venue as Saudi Arabia works to ease foreign investor restrictions. Speaking at FII Priority Asia in Tokyo, he said Saudi aims to be “the centre for IPOs within the region, probably globally for certain sectors,” after a sharp rise in listings that saw 40+ IPOs in recent years, compared with only five annually a decade ago. Tadawul has also secured regulatory approval for Saudi Depositary Receipts to enable future cross-listings, while the Capital Market Authority is consulting on rule changes to boost foreign liquidity. Despite the index falling 12.7% this year, Saudi remains the GCC’s largest IPO market by volume and proceeds, with more than $3.9B raised in 2025 to date.