Happy Friday, friends 👋

All that breathless chatter around Dubizzle’s long-anticipated IPO appears to have been in vain. Earlier this week, the company pulled its listing just one day before book-building was set to begin. Official whispers point to a soft market for recent listings. In truth, that was hardly a revelation. A more convincing explanation perhaps is a valuation mismatch, with the $2BN figure not quite hitting the spot for investors.

It’s a tale of two cities in real estate classifieds. While Bayut’s parent company, Dubizzle, hesitates, Property Finder is pressing full steam ahead. This week it secured $250M in debt financing and quietly backed Stake, the fractional real estate platform, in an undisclosed investment. Stake itself has just launched StakeOne, a full-stack product that lets anyone globally buy, manage, rent, and sell entire properties through a single app. One door closes, another opens.

Elsewhere, the funding taps are still flowing. Self-styled “Rippling for MENA”, Cercli announced a $12M Series A, led by European VC Picus Capital. The company says it has grown revenue more than tenfold in the past year and now processes over $100M in payroll annually across 50 countries.

Another headline-grabber was a $9M seed round for 1001 AI, founded by Bilal Abu-Ghazaleh, a Scale AI alum. The company is aiming to build AI infrastructure for critical industries across MENA. The round was led by CIV, General Catalyst, and Lux Capital, with a chorus of heavyweight angels in tow.

And, finally, a hint of M&A momentum. Spend management platform Qashio has acquired Saudi-based Sanad Cash to accelerate its push into the Kingdom. And in Egypt, BasharSoft, the firm behind Wuzzuf and Forasna, has snapped up iCareer, suggesting that some consolidation on the job listings front may be building beneath the surface.

This and more below 👇

This week’s round-up is a 5 min read:

🚀 Startup funding round-up

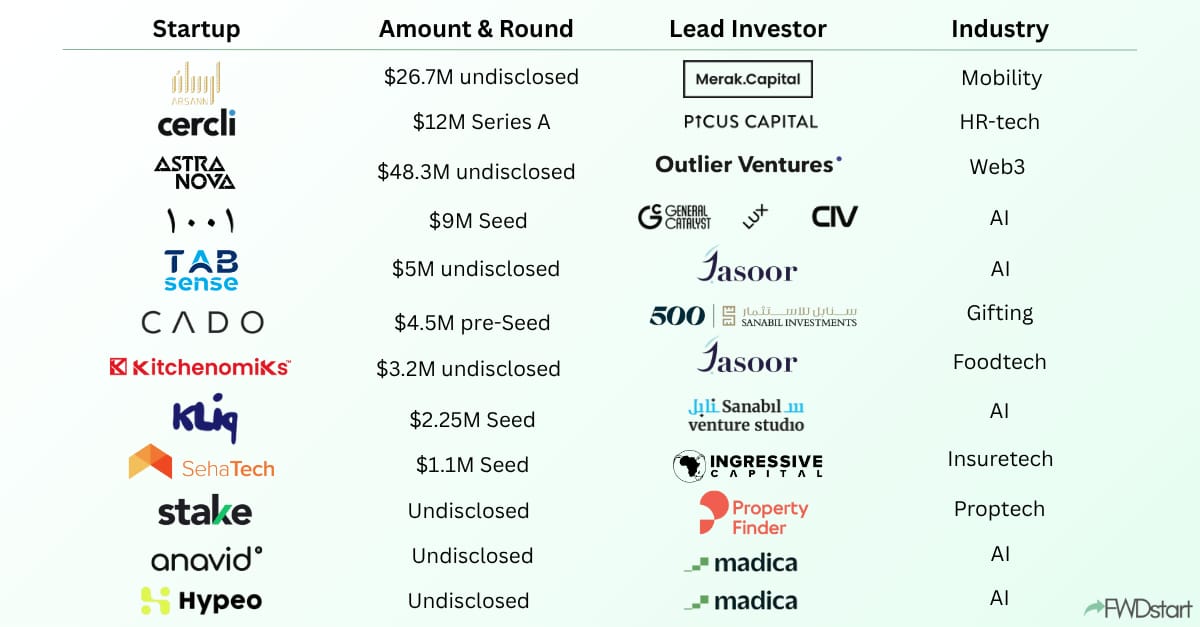

Arsann (🇸🇦 KSA), a smart parking and mobility solutions provider, has raised $26.7M in a strategic investment from Merak Capital to expand its on-street parking networks, participate in national giga projects, and scale its technology infrastructure for real-time parking and traffic visibility.

Cercli (🇦🇪 UAE), an HR-tech startup modernising payroll, compliance, and HR systems, has raised $12M Series A led by Picus Capital (its first MENA investment), with participation from Knollwood, Y Combinator, Afore Capital, and COTU Ventures, to scale across the region’s $5.8B HR software market.

Astra Nova (🇸🇦 KSA), an AI-focused Web3 entertainment and infrastructure firm, has raised $48.3M from Outlier Ventures, regional family offices, and institutional investors to expand its creator platforms and tokenised content tools across the Middle East, Europe, and Asia.

1001 AI (🇦🇪 UAE / 🇬🇧 UK), a deeptech startup building an AI-native operating system for automating operational decision-making in industries like aviation, logistics, and construction, has raised $9M Seed led by CIV, General Catalyst, and Lux Capital, with participation from prominent angel investors, to support early Gulf deployments and team expansion.

TabSense (🇸🇦 KSA), a platform deploying AI agents to run multi-branch restaurant operations, has raised $5M in its first funding round led by Jasoor Ventures to accelerate product development and expand regionally.

KitchenomiKs (🇴🇲 Oman), a foodtech startup operating 13 virtual brands and enterprise-scale F&B services, has raised $3.2M in a round led by Jasoor Ventures, bringing total funding to $6.7M, to expand its satellite kitchen network across the GCC and scale its AI-driven platform KiKsIQ.

CADO (🇦🇪 UAE), a premium gifting platform, has raised $4.5M pre-Seed led by Sanabil 500 and angel investors to expand in Saudi Arabia and launch in New York.

KLIQ (🇸🇦 KSA), an AI-powered influencer marketing platform, has raised $2.25M seed led by Sanabil Venture Studio and Stryber to build out AI capabilities and scale brand–creator onboarding.

SehaTech (🇪🇬 Egypt), an insurtech company automating health insurance administration, has raised $1.1M seed, bringing total funding to $2M, led by Ingressive Capital with Plus VC, angel investors, and A15, to scale operations and deepen AI automation tools.

Stake (🇦🇪 UAE), a digital real estate investment platform enabling fractional property ownership, has secured an undisclosed investment from Property Finder.

Anavid (🇹🇳 Tunisia) has secured up to $200K from Madica to scale its AI-powered retail loss prevention platform and accelerate growth through Madica’s 18-month programme.

Hypeo AI (🇲🇦 Morocco) has raised up to $200K from Madica to expand its influencer marketing automation platform with support from Madica’s 18-month growth programme.

Recent deep-dives

💸 VC

💼 Crescent Enterprises has launched a $68 million programme to expand its venture-building arm CE‑Creates, part of a wider plan to scale UAE-born startups globally. The venture studio, which backs early-stage companies through a structured build-and-scale model, has appointed Rakhil Fernando as its new head. CE-Creates’ portfolio includes Kava & Chai, ION, and BreakBread.

🎓 University of Dubai has launched a AED 100 million Dubai Tech X Fund with Significa Ventures to boost the UAE’s deep tech and AI ecosystem. The fund will back startups in energy, healthcare, education, and smart cities, linking academic research with venture capital to scale innovation.

🧬 Hub71 has launched Hub71+ Life Sciences to support BioTech, MedTech, and digital health startups with direct access to hospitals, regulators, and investors. Backed by the Department of Health – Abu Dhabi, Emirates Drug Establishment, and the HELM cluster, the platform aims to speed up clinical validation and market entry.

📈 Public markets

🏢 Dubizzle has postponed its planned IPO on the Dubai Financial Market just one day before book-building was set to begin, saying it will reassess the timing of the offering. The company had intended to float 30% of its shares, in a deal that could have valued it at around $2 billion. The decision follows mixed performances from recent UAE listings such as Alec Holdings PJSC, Talabat Holding Plc, and Lulu Retail Holdings Plc, all trading below their offer prices. Analysts say the delay likely reflects a gap between market and company valuation expectations. Backed by Prosus N.V., Dubizzle raised $200 million in 2022 from Affinity Partners and currently generates 89% of its revenue in the UAE, with operations across MENA.

💰 Fintech

📱 Tamara has secured a restricted finance licence from the Central Bank of the UAE (CBUAE), enabling it to potentially expand beyond its previous buy-now-pay-later (BNPL) offering into a broader range of payment and credit products under regulated status. The new licence means Tamara can roll out direct lending, short-term credit and full payment services locally.

🇱🇧 Whish Money, a Beirut-based fintech, has secured its first international financial services licenses in Canada, marking the start of a global expansion targeting major Western markets with large diaspora communities. The company plans to pursue additional licenses in the US, UK, EU, and Australia, enabling fully regulated, in-country operations. Founded during Lebanon’s financial crisis, Whish Money has grown to over 1.5 million users through payroll, money transfer, and bill payment services.

📱 barq has secured In-Principle Approval (IPA) from the State Bank of Pakistan to launch an EMI wallet. The approval allows barq to move toward full commercial licensing, after which it plans to offer e-wallets and mobile payment services. barq entered the market by acquiring the Saudi, Pakistani, and UAE units of MyTM and has already surpassed 7 million users in Saudi Arabia.

🏠 Proptech

🏡 Property Finder has secured a $250 million debt financing commitment from Ares Credit Funds to accelerate its regional expansion and product innovation. Founded in Dubai in 2007, the platform plans to invest in AI-driven solutions, marketing, branding, and strategic partnerships.

To that end, Property Finder yesterday announced an undisclosed investment in UAE-based digital real estate investment platform Stake which allows users to buy fractional property ownership. Last week the proptech, which has backing from Mubadala, Wa’ed Ventures, MEVP, and Republic.com, launched StakeOne, a new product that lets anyone globally buy, manage, rent, and sell full properties through the app, expanding beyond its fractional ownership roots.

🤝 M&A

💳 Qashio has acquired Sanad Cash, one of Saudi Arabia’s earliest expense management startups, for an undisclosed amount. The deal accelerates Qashio’s expansion in the Kingdom, combining its spend management tech with Sanad’s local network. It follows Qashio’s $19.8 million funding round in May and will give Saudi clients access to Qashio’s infrastructure across the EU, UK, and UAE. The company also plans to hire more than 120 people globally over the next six months.

👷 BasharSoft, the company behind Wuzzuf and Forasna, has fully acquired iCareer for an undisclosed amount. Founded in 2009, BasharSoft connects over 9 million job seekers with 100,000+ employers and is expanding into Saudi Arabia, the GCC, and wider MENA. The deal also includes Recruitera, Egypt’s first ATS SaaS platform, which will be integrated into Wuzzuf and Forasna to improve data-driven job matching. BasharSoft plans to add 100 employees, target $25 million in revenue, and pursue more acquisitions in JobTech and HR ahead of a potential IPO in 2–3 years.

💸 International investments

🧬 Mubadala Capital has joined a $183 million Series C round for Electra Therapeutics, which is developing a drug for secondary HLH, a rare immune disease that can cause organ failure and be fatal if untreated. The treatment, now in late-stage trials, works by targeting overactive immune cells. The round was co-led by Nextech and EQT Life Sciences, with participation from Sanofi and HBM Healthcare Investments.

🧪 Wa’ed Ventures, has led a $10 million Pre-Series A round in Kure Cells, a US biotech developing same-day CAR-T cancer treatments. Kure’s UF-CAR platform cuts production from weeks to under 24 hours and has shown an 88% complete response rate in non-Hodgkin lymphoma patients. The funding will help the company set up R&D and manufacturing in Saudi Arabia.

🕶️ PIF has invested $205 million in Magic Leap, bringing its total investment in the US-based AR/XR company to more than $1 billion. Once one of the most hyped startups in tech, the company has struggled to turn a profit and fallen short with its consumer hardware. The fresh capital will support the rollout of Magic Leap’s enterprise-focused extended reality tools across industries like healthcare, manufacturing, and defence. PIF became the company’s majority shareholder in 2022 and previously invested $750 million between 2023 and 2024.