Happy Friday, friends 👋

The infamous summer lull just doesn’t seem to have materialised this year. It’s becoming a cliché to open a Friday edition by saying there’s an enormous amount to cover, but once again, we find our hands tied.

To kick us off, Abu Dhabi’s MGX is reportedly weighing a $25 billion AI infrastructure fund, exploring a stake in French AI outfit Mistral, and shaping up as a prominent backer in Anthropic’s imminent $170B+ rumoured round – seemingly unperturbed by recent comments from CEO Dario Amodei about taking regional capital.

In fintech, Dubai-based expense-management platform Alaan has raised a colossal $48 million Series A to scale its AI finance agents across MENA, in what is becoming a hyper-competitive space with competitors like Qashio, Pemo, and Pluto also securing funding in recent months.

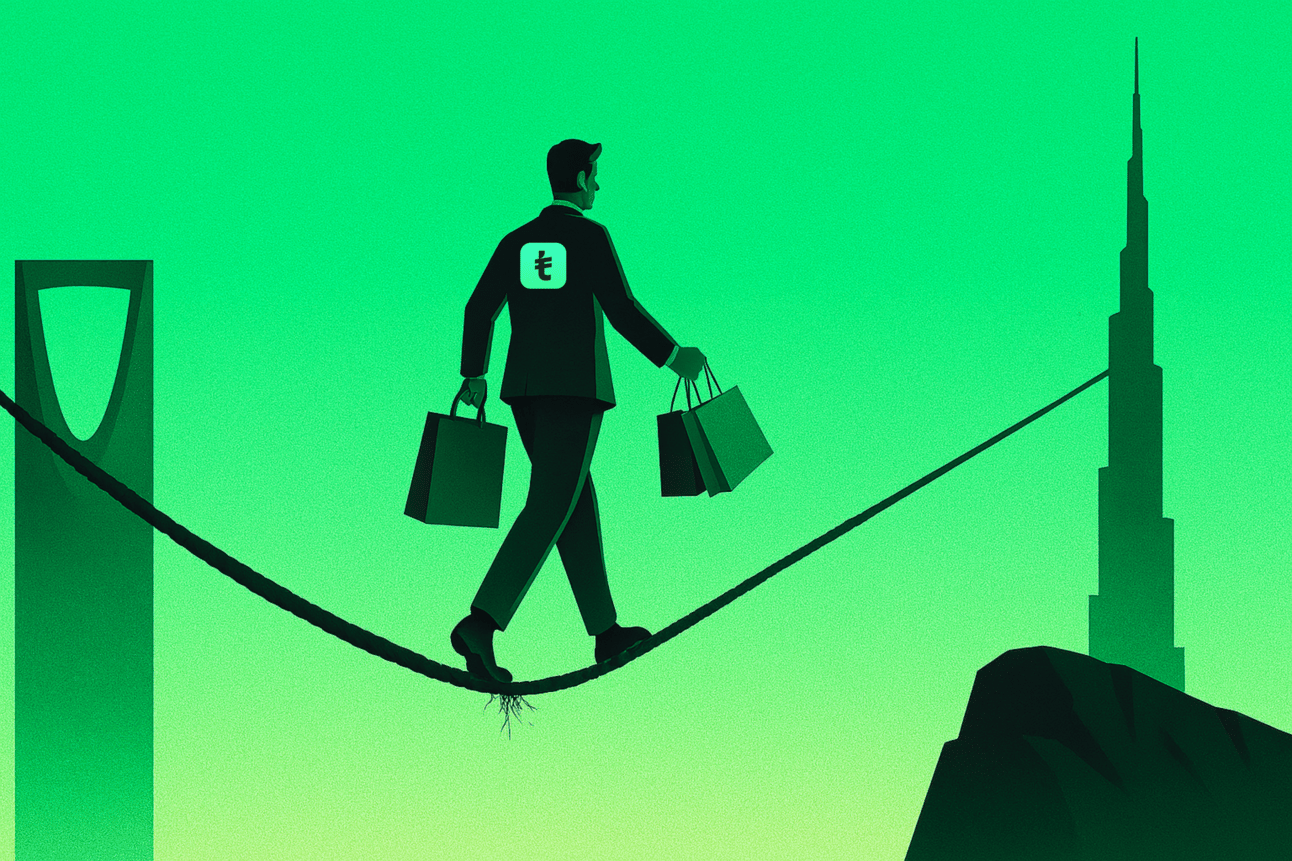

And so much for the so-called Series B funding gap! We jest, but another sizeable B-round has landed this week. Riyadh-based Salasa will use its $30 million raise to embed AI across its e-commerce fulfilment operations, expanding bonded zones, dark stores, and cross-border shipping.

We also want to draw attention to Egypt-born Kareem Amin, whose startup Clay, founded in 2017, has just raised $100 million from CapitalG at a $3.1 billion valuation.

Now, let’s get into this week’s edition 👇

This week’s round-up is a 5 min read:

20-Minute Masterclass: Book 3× More Meetings with AI Outreach

Live 20-min workshop • Wed (1 pm GMT+1 / 11 am CET)

In just 20 minutes, discover the AI-powered outreach playbooks that took startups from $1M → $5M ARR without extra headcount.

✔️ Why generic outreach is dead

✔️ Live build: AI email & video script

✔️ 3-tier follow-up system

✔️ Orchestrate email + LinkedIn + phone

✔️ Case study: +250 % revenue

🚀 Startup funding round-up

Salasa (🇸🇦 KSA), a Riyadh‑based e‑commerce fulfilment platform providing warehousing, inventory management, last‑mile delivery, and cross‑border shipping, has raised $30M in a Series B led by Artal Capital to embed AI across its operations, expand bonded zones and dark stores, and grow international shipping capabilities.

Suplyd (🇪🇬 Egypt), a Cairo‑based digital procurement platform for the HORECA sector enabling restaurants to order directly from suppliers, has raised $2M in a pre‑Series A led by 4DX Ventures, Camel Ventures, and Plus VC to expand into new service verticals, deepen its footprint in Egypt, and invest in platform upgrades.

Wuilt (🇪🇬 Egypt), a Cairo‑based e‑commerce enablement startup that began as an Arabic‑language website builder and now offers a free platform for merchants, has raised $2M from Flat6Labs, MTF VC, and others to expand to the UAE and GCC, launch in Turkey, and roll out AI‑powered merchant tools.

Boxy (🇮🇶 Iraq), an AI-powered logistics aggregator unifying Iraq’s 1,500+ last-mile couriers into a single intelligent shipping platform, has raised $1.5M in pre-seed funding from EQIQ to support proprietary tech development and expansion across Baghdad and provincial cities.

DEEP.SA (🇸🇦 KSA), a Saudi‑born AI startup developing AI engines and specialised AI agents for consumer and government markets, has raised $1.2M in a pre‑seed backed by TAM Development and RAED Ventures to accelerate product development, drive enterprise and government adoption, and expand internationally.

RIFD (🇸🇦 KSA), a Shariah‑compliant SME receivables securitisation platform, has secured an undisclosed investment from Antler to build Saudi Arabia’s first institutional‑grade infrastructure for securitising SME receivables with the goal of lowering financing costs for small businesses, and expanding institutional partnerships.

Catch up on recent deep-dives

💸 VC & PE

💼 F6 Group has unveiled F6 Ventures, a seed-stage VC arm with $90 million AUM across six funds. Co-founded by Dina el-Shenoufy and Ramez El-Serafy, the firm targets pre-seed and seed startups across Africa, the GCC, and the Levant and plans to reach $200 million AUM and back 200+ startups within five years. Its sister entity Flat6Labs, now led by CEO Yehia Houry, will continue to run accelerator programs and founder-support initiatives under the same F6 Group umbrella.

💼 Afaq Capital has acquired the entire venture portfolio of Falak Investment Hub, marking what’s being described as the region’s first secondary entry-and-exit VC transaction. The deal, pending final regulatory approval, offers investors access to a pre-assembled portfolio of Saudi and regional startups, originally built by Hassan Ikram during his time as Falak’s co-founder and CIO.

💼 Mumtalakat, Bahrain’s sovereign wealth fund, has taken an undisclosed minority stake in Abu Dhabi private-equity firm BlueFive Capital, which manages more than $2.6 billion and closed a $2 billion GCC growth fund last year.

📣 Endeavor Jordan has appointed Tamer Al-Salah as Managing Director, effective 1 August, bringing him back to the organisation where he began his career in entrepreneurship support and later co-founded the Beyond Capital partnership with Silicon Badia.

🏠 The Dubai Land Department has partnered with Second Century Ventures to launch REACH Middle East, a new accelerator for PropTech startups across MENA. Led by Siddiq Farid and Karim Helal, the eight-month program will back up to 10 seed-to-Series A companies with up to $250K each, plus access to pilots with major developers and government bodies.

🤖 AI

🤖 Groq and HUMAIN have launched OpenAI’s open-weight gpt-oss-120B and 20B models on GroqCloud with day-one access in Saudi Arabia. Developers can prototype 20B locally and move to Groq’s Dammam cluster for production, while enterprises can fine-tune 120B on a single GPU for chatbots or RAG, pay HUMAIN in riyals, and keep data onshore for compliance.

💰 MGX, the Abu Dhabi AI investment vehicle backed by Mubadala and G42, is weighing a new fund of up to $25 billion for global AI infrastructure while also negotiating a $1 billion stake in French startup Mistral and joining a planned $3–5 billion round for Anthropic at a $170 billion valuation.

🏦 Central Bank of Jordan has released the country’s first AI framework for banks, setting governance, risk, and data-protection rules to speed safe adoption and support Jordan’s goal of becoming a regional fintech hub. The guidelines, drafted by the bank’s AI steering committee and complemented by its regulatory sandbox, mirror similar moves in Qatar and the UAE.

🤝 Diaspora

🇪🇬 Clay, the US-based go-to-market automation startup co-founded by Egyptian-born Kareem Amin, has raised $100 million in Series C funding led by CapitalG, valuing the company at $3.1 billion. Amin, who grew up in a community of Egyptian medical expats in Saudi Arabia, studied engineering at McGill before launching Clay in 2017. Clay positions itself as the “IDE for go-to-market teams,” and its traction is striking: more than 108 agencies built on its stack, 400 GTM-engineer jobs posted in under five months, and over $50 million paid out to 150 data partners this year.

📈 Public Markets

🎵 Anghami carried out a 1-for-10 reverse stock split on August 4th to avoid delisting from Nasdaq, after its shares fell to $0.0117, well below the $1 minimum bid. The Abu Dhabi–headquartered streamer, once valued at over $220 million, posted its first-ever profit in late 2024 and narrowed its annual net loss to $2.6M. Despite cutting operating expenses by 41% and growing subscription revenue by 28%, Anghami faces mounting pressure: a seven-month reporting gap, declining ad revenue, and rising risk exposure tied to licensed content from OSN+, Sony, Universal, and Warner.

🛵 Food Delivery

🤖 Saudi has launched its most high-profile robot delivery trial to date, with five autonomous food delivery robots now operating at ROSHN Business Front in Riyadh. The pilot is a collaboration between Jahez, the Transport General Authority, and PIF-backed ROSHN Group, with robots developed under ROSHN’s innovation arm, ROSHNEXT. It follows Jahez’s earlier LEAP24 trials and comes just a week after Uber and WeRide launched the Kingdom’s largest autonomous vehicle pilot.

🌍 International Investments

⚡ GE Vernova has acquired French AI software firm Alteia, a portfolio company of Saudi Aramco’s Wa’ed Ventures. While the deal value wasn’t disclosed, it marks a notable exit for the $500M fund, which led Alteia’s seed round in 2022. Alteia’s platform, now integrated into GE Vernova’s GridOS Visual Intelligence, helps grid operators and infrastructure players manage physical and compliance risks using AI.

🐍 Anaconda, a leading Python distribution platform for data science and AI, has raised $150M in a Series C co-led by Abu Dhabi’s Mubadala Capital and Insight Partners to accelerate AI feature development, pursue acquisitions, and expand into new markets.

With thanks to our sponsors:

This week on VC React, we break down Meta’s eye-watering billion-dollar overtures to Mira Murati’s newborn Thinking Machines Lab, taste-test Calo’s $64 million war-chest for its AI “private-chef” push, tune in to Sawt’s Arabic voice-bot gambit, and decode the UAE’s brand-new open-finance rails.