In keeping with last year’s tradition, today’s deep dive is us peering into our crystal ball once again and laying out the trends and developments we expect to either materialise or gather real momentum over the course of 2026.

We know predictions for the year ahead are a dime a dozen. That said, we’re publishing ours anyway. If nothing else, it keeps us honest.

On that note, before we get into this year’s calls, it feels only fair to briefly revisit how our predictions from last year actually played out.

First up, our call that AI would be everywhere proved to be prescient, albeit obvious. We offered very little specificity at the time as to how this would play out across startup funding, VC formation, sovereign strategies, and beyond. In hindsight, that lack of precision may have been the most accurate framing of all, given how comprehensively AI came to dominate virtually every corner of the ecosystem over the past 12 months. One point.

Another area where we’ll give ourselves a tick is our belief that construction tech was on the precipice of a breakout year in 2025. We saw a proliferation of construction focused startups raising capital, from Wakecap to BRKZ to Builtop, TruBuild, and Buildroid (that’s a lot of Bs, try saying that 3 times quickly) and more. A hint, if struggling to come up with predictions, you could always be well-served by opting for one of Vision 2030's strategic priority areas. Two points.

Elsewhere, we called that foreign investors would meaningfully increase allocations into regional startups in 2025, particularly at growth stage and beyond. Per MAGNiTT, that’s exactly what happened. For the first time in recent history, international investors deployed more capital into MENA startups than local backers, accounting for roughly 50% of capital in Q3 alone and 51% of all unique investors across the first nine months of the year. We’ll allow ourselves a loud “we told you so” on that one. Three points.

Where we admittedly jumped the gun was on regional startups making their public market bows. Our prediction that the likes of Tabby, Floward, Salla, and TruKKer would list last year proved overzealous. That said, we’ll be recycling this prediction again later, albeit with a bit more nuance this time around. No points.

And finally, in a similar vein, our call that 2025 would be the year secondaries truly emerged in the region was also a little too early. Globally, secondaries certainly had a moment, with players like Industry Ventures, Forge Global, and EquityZen all involved in major transactions with large financial institutions. That, however, was not what we were predicting locally. No points awarded there.

All in all, 3/5 ain't half bad. In hindsight, we did miss the open layups that were the SME financing gap and the ascent of debt financing… which is pretty frustrating, but let's see if we can put things right in our 2026 look ahead.

As a small thank you for all of your support over the past twelve months, we’re dropping the paywall for this piece for those of you who are new to the publication.

Every Wednesday, we publish a deep dive exclusively for premium subscribers. If you enjoy what we do, would like to read more of our analysis, and want to support the publication, you can sign up for a premium subscription here. To celebrate the new year, we’re offering 25% off.

Your support genuinely means the world to us and enables us to keep investing in thoughtful, original coverage. Enjoy!

🔔 The IPO logjam finally breaks

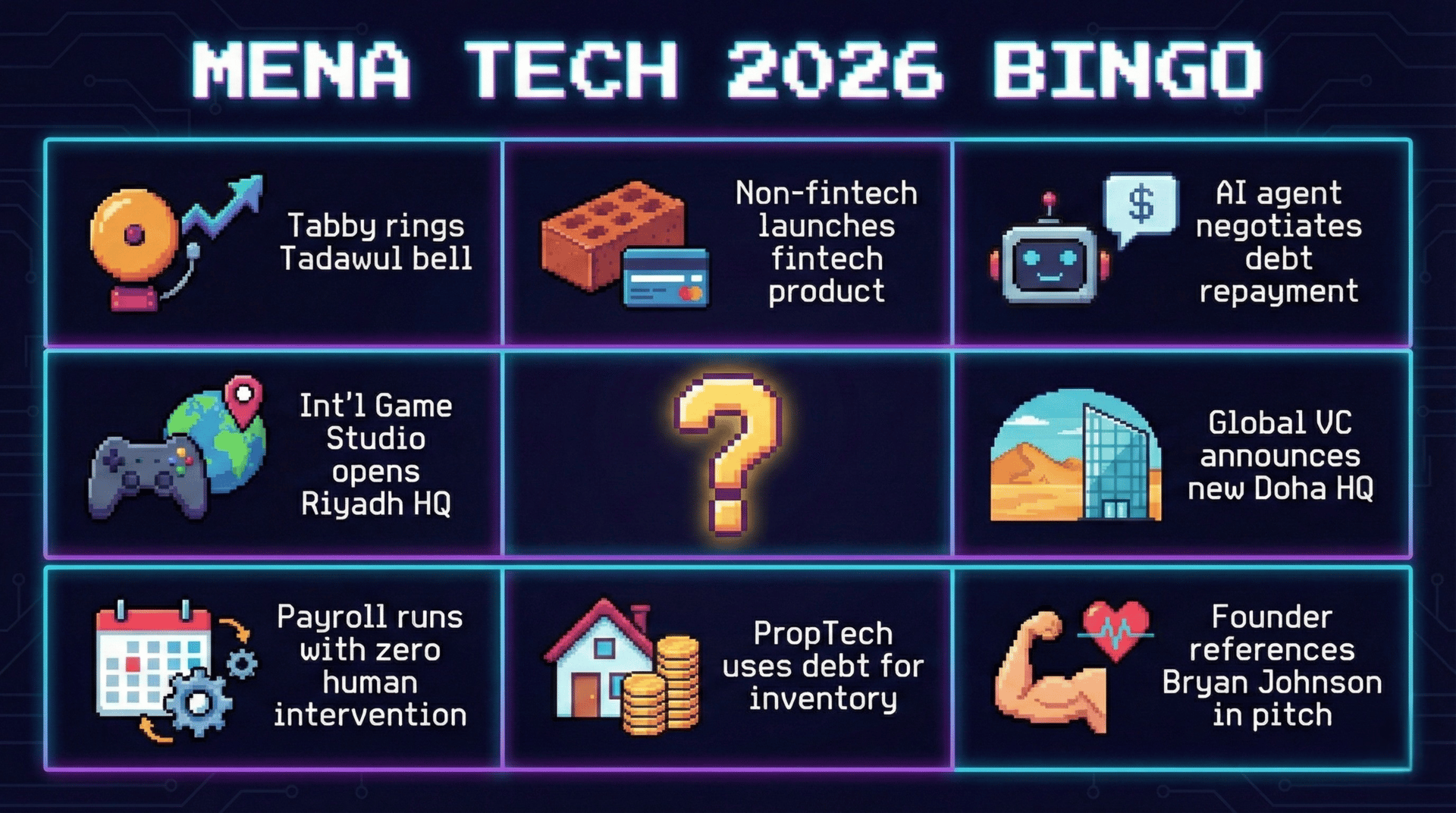

No case of once bitten, twice shy here. Hoping this isn’t a textbook example of sunk cost fallacy, we’re doubling down on our prediction that 2026 will be the year regional startups begin ringing the Tadawul bell in earnest.

The much anticipated wave of listings we were promised last year ultimately turned into a trickle. Geopolitical hesitation and a lukewarm reception for recent debutants on both the DFM and Tadawul saw several high profile players hit the pause button, quite literally in the case of Dubizzle.

That said, dams can only hold for so long. We’re cautiously optimistic that 2026 could be the year the backlog finally begins to clear. Emphasis on begins. Our base case is still modest, perhaps 2 to 3 listings depending on timing, market conditions, and how early movers are received. As ever, plenty can change. If Tabby pops, and keeps popping – bullish.

That optimism could be further reinforced by the announcement last week that all categories of foreign investors will be able to invest directly from February 1. Another bullish signal?

Foreign capital has long been a bottleneck. Until now, international investors largely had to operate through the Qualified Foreign Investor framework or via cumbersome swap agreements, effectively limiting meaningful participation to the BlackRocks and Vanguards of the world.

Opening the door more fully should deepen the liquidity pool. International ownership had already reached $157B by Q3 2025 with the brakes firmly on. With those constraints eased, we may see not just more capital, but faster capital. That kind of liquidity is particularly attractive to late stage VCs looking for reassurance that public markets can absorb multi billion dollar positions once lockups expire.

Some informed spitballing here, but this shift could in particular disproportionately benefit consumer facing tech companies over more traditional industrial firms. Think the likes of Tabby, Floward, or Ninja. Brands with strong recognition not just in Saudi, but across the GCC and among global expat communities.

As we all know, tech valuations often thrive on retail sentiment. By allowing foreign individuals and smaller entities to trade directly, the Capital Market Authority may have unlocked a fan base that can finally put its money where its mouth is.

Now comes the hard part. Let’s hope the frontier founders bold enough to step into the public markets can sustain those valuations once the bell has been rung.

🏄♂️ The debt wave continues

We wrote extensively about the ascent of debt financing throughout 2025. By our reckoning, well over $1B has been earmarked for deployment over the past 18 months alone, driven by the continued presence of regional stalwarts like PFG, alongside the arrival of newer players such as Stride Ventures, which landed with a bang last year backing the likes of BRKZ and Erad.

We see few signs that deployment will slow, particularly if the trend we’ve come to think of as the “fintechification” of everything continues. As a16z’s Angela Strange put it back in 2019, “In the not too distant future, I believe nearly every company will derive a significant portion of its revenue from financial services.” That thesis is finally materialising in MENA in a meaningful way.

Celebrate 2026, with 25% off a premium subscription

Offer ends midnight Sunday, 18th January

The likes of BRKZ in construction, Nawy in proptech, and OCTA in accounts receivable all fit this mould. Elsewhere, the merger between Sary and ShopUp earlier this year led to the creation of a dedicated fintech offshoot, SilqFi, with an explicit mandate to leverage their existing retailer and supplier networks to deliver working capital solutions at scale.

Layered on top of this is the rise of startups operating in the credit intelligence stack. Players like Orbii and Abwab are building the infrastructure required to unlock SME lending, helping capital providers underwrite risk more effectively, and in turn, pushing more capital into parts of the market that have historically been underserved.

Taken together, these dynamics should enable more marketplace and logistics led platforms to monetise their proprietary data and embedded relationships. Likely candidates could include B2B supplier marketplaces like Cartona, logistics players such as Trella, and commerce platforms including Salla, Foodics, and Zid, many of which are already experimenting with embedded finance or are expected to double down on fintech adjacencies over the coming months.

We also expect the region’s Ramp and Brex equivalents to push further down the credit curve. Think Alaan, Qashio, Pemo, Pluto and others continuing to expand and diversify their product offerings. It wouldn’t surprise us to see Alaan raise a sizeable debt facility later this year specifically to underwrite deeper moves into working capital or credit lines.

Proptech feels like another obvious beneficiary. Companies like Stake, which has already signalled ambitions beyond pure fractional ownership with the launch of StakeOne, could theoretically use debt far more aggressively to scale property acquisition. Off the back of a $5M pre-Series B (all equity we’re assuming), and with a Series B reportedly earmarked for early 2026, pairing equity with structured debt for inventory warehousing could be a next step?

All of which is a long winded way of saying one thing: expect a lot more debt to continue to be deployed across the region in 2026.

🤖 AI agents & the boring back-office

In 2026, we expect AI native players in the application layer, in particular, to continue going from strength to strength and to be rewarded accordingly from a funding perspective.

We’re big believers that AI’s impact will be felt most acutely in the systematic replacement of the most thankless work in the economy. Think debt collection, support, billing, payroll. Industries built on repetition and scale, where the default solution for decades has been to throw more people and offshore BPOs at the problem.

These are precisely the domains where AI agents should thrive. They don’t get tired, distracted, or bored, and they operate inside workflows so inefficient that even modest gains compound quickly.

Call centres are a clear example. The traditional stack of Avaya or Cisco hardware layered with outsourced workforces leaves most call data unused. As we’ve previously opined, Arabic voice stacks are flipping this with the likes of Maqsam, Intella and Sawt.

Collections follows the same logic. Instead of brute force calling, ClearGrid uses prediction to decide when, how, and through which channel to engage debtors, and negotiates repayment automatically with AI voice agents.

Customer support is perhaps the most obvious battleground. We’re rapidly moving past the era of short-term resolution, which patches a symptom but rarely addresses the root core problem, to an era of true autonomous action. While globally, the likes of Fin by Intercom and Bret Taylor’s Sierra, are moving the industry beyond simple chatbots to agents capable of executing complex workflows, Clarity is the prime example picking up that mantle locally. Co-founded by Abed Kasaji, another alumnus of the Careem mafia, they have moved aggressively to deploy "agentic AI" and now count Careem, Grubhub and STC amongst their customers.

Healthcare billing is another obvious target. Months long payment cycles caused by rejected claims are being compressed by platforms like Klaim, which pre screen claims, assign correct codes, and flag rejection risk before submission.

Even payroll, often framed as a people problem, is in reality a data entry problem. Cercli is attacking the space from an AI native starting point, and in doing so may increasingly win out over earlier generation platforms like Bayzat and ZenHR that were built for a more manual, rules based era. That’s not to say it can’t be done though, Deel’s aggressive pivot to an AI-first operating model exemplifies this.

The companies that win will be the ones that feel less like tools you buy and more like digital teams you hire.

⛑️ Wellness, longevity & healthcare

This could be a big year for healthcare focused startups, particularly those sitting at the intersection of wellness and longevity. Healthcare now feels firmly embedded as a top tier strategic priority for several Gulf states, notably Saudi Arabia, Qatar, and the UAE, with sovereign capital increasingly being deployed in a deliberate and coordinated way.

Qatar, in particular, appears to be pursuing a very deliberate and somewhat different sovereign approach to stimulating a local startup and VC ecosystem. Through Qatar Investment Authority’s $1B fund of funds programme, the emphasis has been on backing established VC firms elsewhere and encouraging them to set up local headquarters and on the ground teams, effectively importing expertise rather than trying to grow it organically from scratch. There is a very clear mandate from QIA around healthcare, and that focus is already evident in the firms that have received backing to date.

Take Deerfield Management, one of the first tranche of VC firms to receive QIA support, alongside Utopia Capital Management. These two may prove to be among the most impactful early stage entrants in Doha. Deerfield has since announced the launch of a healthcare specific accelerator, The Cure. While timelines are still a little opaque, it seems likely that the programme will graduate at least its first cohort, if not a second, over the course of 2026, which should start to bring more healthcare startups into existence locally.

Utopia, meanwhile, has launched its venture builder arm, The Studio, built around a pod style structure, with each pod centred on a specific thesis capable of spawning multiple ventures. Their “Sovereign Systems” pod in particular feels well aligned with healthcare, especially as Qatar looks to double down on national digital stacks across critical sectors.

On the local side, Rasmal Ventures has already begun deploying into healthtech, having co led the Series A for MedIQ in May 2025. Healthcare is one of Rasmal’s stated focus areas, and they likely play an important role as connective tissue between pilots, institutions, and capital on the ground.

That said, we still expect the majority of healthcare specific startups raising funding in 2026 to come out of Saudi Arabia. Sanabil Venture Studio has been particularly active when it comes to building and seeding healthcare focused companies. We saw this with Kilow, which combines GLP 1 medication with lifestyle modification programmes to address obesity, and Nuxera AI, which is focused on streamlining medical documentation and clinic management, broadly comparable to something like Abridge in a US context.

Nuxera was also the first startup to emerge from Sanabil’s newly launched venture studio, built in collaboration with US based healthcare focused VC firm Redesign Health. Redesign has a long track record of company creation globally, having launched dozens of healthcare startups, and in December 2024 announced a fresh $175M fund to continue scaling that model. Taken together, it would not be surprising to see a steady pipeline of healthcare companies coming out of this studio over the course of 2026.

And perhaps the original proving ground for all of this is the UAE. We saw meaningful healthcare rounds there last year, including for the aforementioned Klaim, as well as cancer treatment platform BioSapien, which was originally drawn to the country via Hub71. In October 2025, Hub71 announced the launch of a dedicated new stream, Hub71+ Life Sciences, focused specifically on biotech, medtech, and digital health.

Given Abu Dhabi’s comparatively accessible clinical trial environment and increasingly targeted ecosystem support, it feels likely we’ll see more healthcare startups not just pass through, but actively choose to set up and scale from the capital.

Bryan Johnson, eat your heart out.

🕹️ Saudi gaming keeps winning

Last but not least, and once again this does feel a little like cheating, much like last year’s construction tech call, Saudi Arabia’s national gaming and esports strategy under Vision 2030 makes this one feel almost inevitable. The ambition to position the Kingdom as a global gaming hub should see the funding floodgates that opened last year for homegrown gaming studios and startups continue to flow in 2026.

On the local capital side, there is already dedicated infrastructure in place. Impact46 is actively deploying out of its SAR 150M gaming fund, while Merak Capital operates a gaming focused accelerator, Exel by Merak. The two joined forces across a number of Exel’s accelerator graduates last year, which on one level may point to a still emerging pipeline of truly investment ready gaming startups, but also underscores how tightly capital, acceleration, and national strategy are currently aligned.

What changes the equation looking ahead is the broader ecosystem coming into focus. Qiddiya Gaming District is inching closer to reality, and PIFs acquisition of EA could accelerate the arrival of serious international gaming players to establish regional HQs in Riyadh.

We may not see the full trickle down effect of that immediately in 2026, but it should support a steady pipeline of Saudi gaming studios and esports startups, alongside companies founded by regional diaspora tempted back to the Kingdom to build.

So there you have it, those are our predictions for the year ahead. Agree or disagree, send us an email at [email protected].